December 1st, 2017 by tisner

FHA insured mortgages serve a sector of the market that is not necessarily being met by other loan programs.

Securing an 80% conventional mortgage that doesn’t require mortgage insurance may be the lowest cost of financing but if the buyer doesn’t have 20% down payment, it isn’t really an option.

Securing a 100% VA loan doesn’t require a down payment or mortgage insurance but if the buyer isn’t a veteran with his/her eligibility intact, it isn’t an option either.

There are conventional loan programs with as little as 3% down payment but they not only require mortgage insurance, they also require a credit score of 740 or above which may eliminate some buyers.

For these reasons, FHA is a viable alternative to about 20% of new and existing home sales. The Federal backing of these mortgages makes it easier for first-time and low-income buyers to qualify because the requirements are not as demanding. They’re even more lenient towards buyers who have previously experienced bankruptcy, foreclosure or a short sale.

Finding the right mortgage for the right home is a team effort where both mortgage and real estate professionals work in harmony to get a buyer into their own home. Call us at 407-566-1800 for a recommendation of a trusted mortgage professional.

General FHA loan requirements include:

- The loan is for primary residences only but can include two, three or four units.

- The property must be appraised by an FHA-approved appraiser.

- The property must be safe, sound and secure, in compliance with minimum property standards as defined by the U.S. Department of Housing and Urban Development.

- The borrower must be a legal resident of the U.S. and have a valid Social Security number.

- The minimum credit score of 580 with a down payment of at least 3.5 percent, or a minimum credit score of 500 with a down payment of at least 10 percent.

- The borrower may not have delinquent federal debt or judgments, or debt associated with past FHA loans.

- The borrower must have steady employment history.

- Documentation is required if the down payment was gifted by a family member.

- The borrower must have a debt-to-income not exceed limits of 31% for front-end and 43% back-end ratio (some exceptions may apply).

- Any judgments or collections on the credit report must be resolved or satisfactorily explained.

By: PatZaby.com

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Tags: fha, home financing, homebuyers, mortgage, mortgage insurance, orlando avenue top team, paying for a house, Teri Isner, The Orlando Avenue Top Team

Posted in Financing, Orlando Buyers | No Comments »

November 10th, 2017 by tisner

Would someone really refinance their home and not take money out of it? Certainly, if they could get a lower rate, build equity faster and pay off the home sooner.

For people with extra cash available, this can be very attractive compared to the low savings rates being paid by banks.

In the example below, the current mortgage is 5% for 30 years after 48 payments of $1,342.05. The owner can refinance for 15 years at 3.37%. If they put $36,000 into the refinance, their payments will be slightly more but the mortgage will be paid off in 15 years. At that same point, if they keep the current mortgage, their unpaid balance will be $136,049.03.

If you have a goal to get your home paid off and have the available funds, a Cash-In Refinance may be just the strategy for you.

By: PatZaby.com

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Tags: equity, homeowners, interest rates, orlando avenue top team, Orlando Sellers, paying for a house, refinance, Teri Isner

Posted in Financing, Orlando Buyers | No Comments »

October 20th, 2016 by tisner

If you are in the market for a new home then the very first step you need to take even before you begin your search for the perfect place is to get a pre-approval on a loan. Most Realtors won’t take you serious about looking for a home until you have your pre-approval. There are a few things that need to take place in order for a pre-approval to be a legitimate one. If your lender tells you that you are pre-approved within just a few minutes you may want to do some investigation to find out if it’s a legit pre-approval or not. Below are a few instructions on what you need to do in order to receive a pre-approval.

- Submit an application with the lender of your choice

- Submit an application with the lender of your choice

- Provide all documentation that the lender requires of you

- Given the go ahead and approval for the lender to pull your credit

- Your lender must have found that you meet all the credit guidelines. They will look at things such as your debt-to- income ratio as well as your assets.

- The lender will have talked with you about what money you need to have together for closing costs as well as what your mortgage payment will be monthly. Your lender will also go over any or all programs that you may qualify for.

- An automated underwriting must be made by your lender before you can move forward with your loan.

If you have a good lender, he or she will talk with you about the different requirements to get a pre- approval and they may even determine that you need to work on a few things first and give it a bit of time before you apply for a pre-approval. Good lenders will spend the time needed with you to figure out where your finances are so that you don’t end up getting in over your head with a home you cannot afford. Take your time looking for a lender so that you have a good match and one that you can trust. After all, buying a home is a big deal and you need to be able to trust those who are leading you into your future and home ownership.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Tags: home loan pre-approval, orlando avenue top team, pre-approval, requirements for pre-approval, Teri Isner

Posted in Financing, General Real Estate, Orlando Buyers | No Comments »

September 16th, 2016 by tisner

In many markets across the country, the amount of buyers searching for their dream homes greatly outnumbers the amount of homes for sale. This has led to a competitive marketplace where buyers often need to stand out. One way to show you are serious about buying your dream home is to get pre-qualified or pre-approved for a mortgage before starting your search.

Even if you are in a market that is not as competitive, knowing your budget will give you the confidence of knowing if your dream home is within your reach.

Freddie Mac lays out the advantages of pre-approval in the My Home section of their website:

“It’s highly recommended that you work with your lender to get pre-approved before you begin house hunting. Pre-approval will tell you how much home you can afford and can help you move faster, and with greater confidence, in competitive markets.”

One of the many advantages of working with a local real estate professional is that many have relationships with lenders who will be able to help you with this process. Once you have selected a lender, you will need to fill out their loan application and provide them with important information regarding “your credit, debt, work history, down payment and residential history.”

Freddie Mac describes the 4 Cs that help determine the amount you will be qualified to borrow:

- Capacity: Your current and future ability to make your payments

- Capital or cash reserves: The money, savings and investments you have that can be sold quickly for cash

- Collateral: The home, or type of home, that you would like to purchase

- Credit: Your history of paying bills and other debts on time

Getting pre-approved is one of many steps that will show home sellers that you are serious about buying, and it often helps speed up the process once your offer has been accepted.

Bottom Line

Many potential home buyers overestimate the down payment and credit scores needed to qualify for a mortgage today. If you are ready and willing to buy, you may be pleasantly surprised at your ability to do so as well.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Tags: Davenport, mortgage pre-approval, orlando fl real estate, real estate, Teri Isner, Winter Haven

Posted in Celebration, Financing, General Real Estate, Kissimmee, Orlando, Orlando Buyers, Windermere | No Comments »

August 26th, 2016 by tisner

Many experts have been calling upon home builders to ramp up construction to help with the lack of existing inventory for sale. For the past two months, new home sales have surged, with July’s total coming in at the highest since October 2007.

The latest estimates from the US Census Bureau and Department of Housing and Urban Development show that sales in July were 31.3% higher than this time last year, and 12.4% higher than last month, at a seasonally adjusted annual rate of 654,000.

Zillow’s Chief Economist, Svenja Gudell, echoed the reaction of some as she commented:

“July(‘s) new home sales data was a surprise, but a welcome one. For years, the market has been practically begging builders to both ramp up their efforts overall and to put more focus on serving the less expensive end of the market. Today’s data confirms both are happening in earnest.”

The National Association of Home Builder’s (NAHB) Chairman, Ed Brady, didn’t seem as surprised:

“This rise in new home sales is consistent with our builders’ reports that market conditions have been improving. As existing home inventory remains flat, we should see more consumers turning to new construction.”

NAHB’s Chief Economist, Robert Dietz, believes this is just the start for new home sales if market conditions continue:

“July’s positive report shows there is a need for new single-family homes, buoyed by increased household formation, job gains and attractive mortgage rates. This uptick in demand should translate into increased housing production throughout 2016 and into next year.”

The existing home sales numbers for July will be released today and will shed more light on the overall health of the housing market.

Bottom Line

New home sales hit their highest mark in over 9 years. Buyers are out in force to find a home that fits their needs. Many are turning to new construction, as the inventory of existing homes has not been able to keep up with demand.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Save

Tags: Davenport, florida housing market, Orlando Communities, orlando real estate, Orlando Sellers, real estate, teir isner, Teri Isner, Winter Haven, www.flhousesales.com

Posted in Celebration, Financing, General Real Estate, Homes, Kissimmee, Orlando, Orlando Buyers, Osceola, Windermere | No Comments »

August 19th, 2016 by tisner

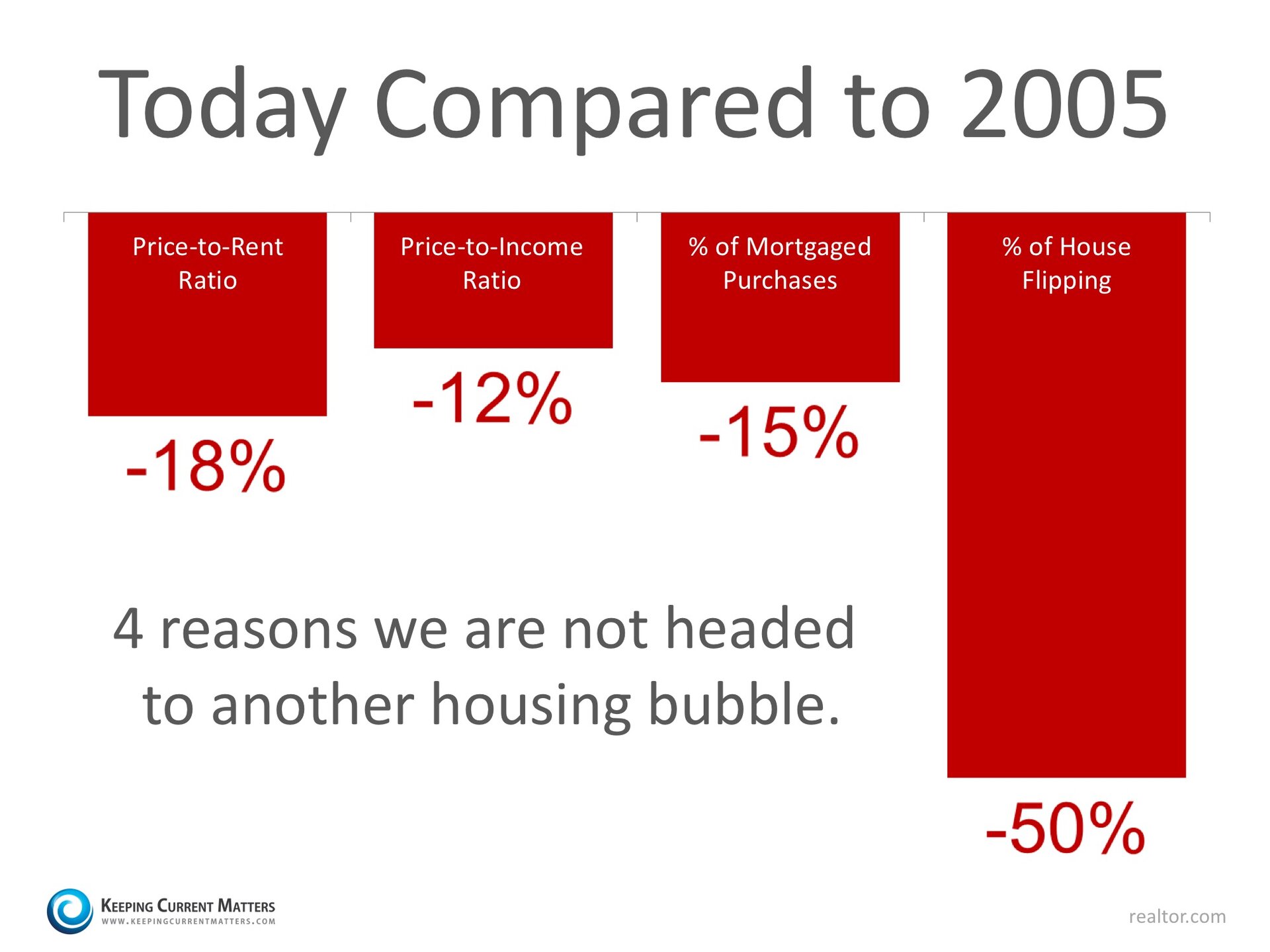

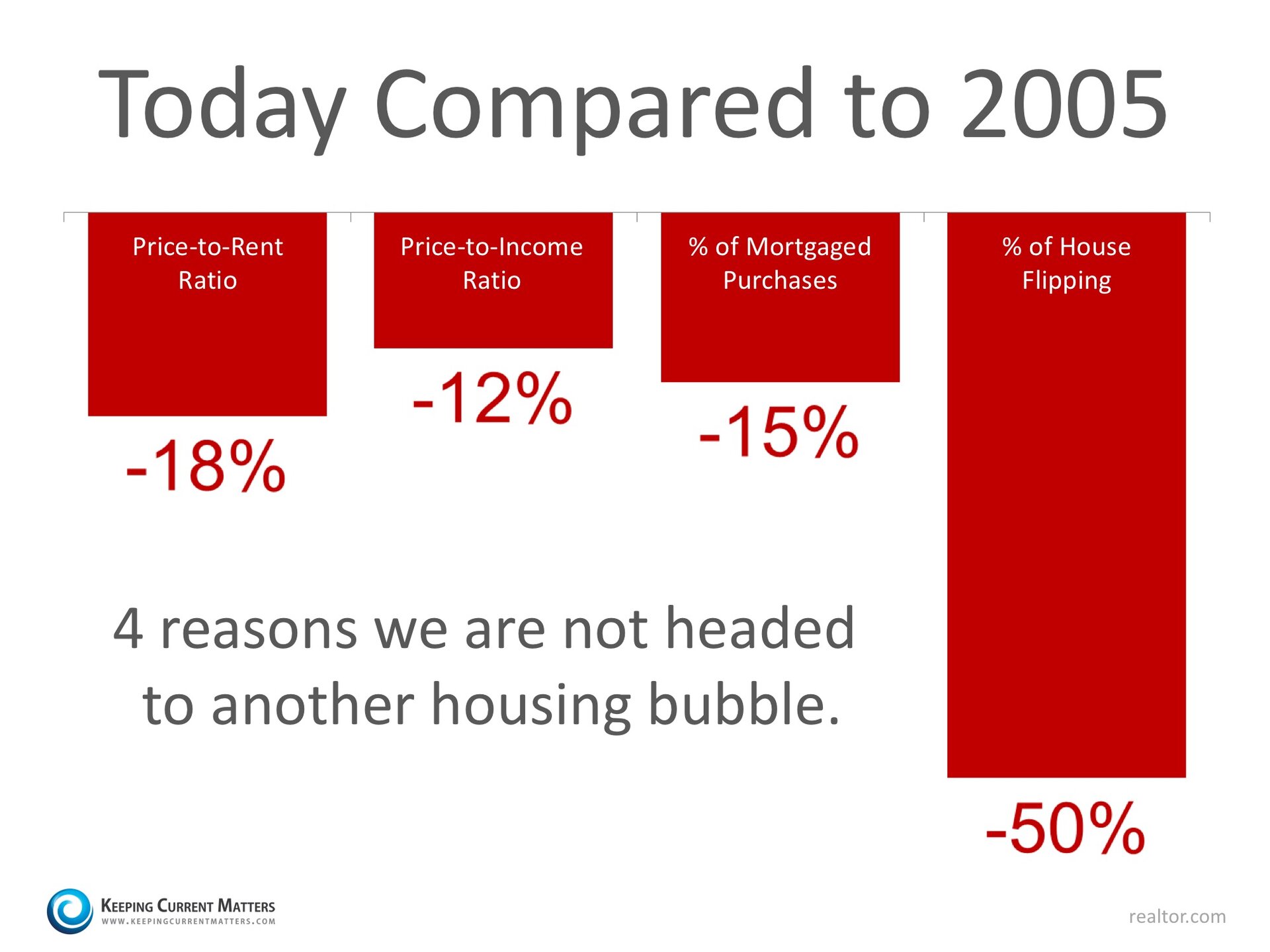

Recent research by the realtor.com examined certain red flags that caused the housing crisis in 2005, and then compared them to today’s real estate market. Today, we want to concentrate on four of those red flags.

- Price to Rent Ratio

- Price to Income Ratio

- Mortgage Transactions

- House Flipping

All four categories were outside historical norms in 2005. Home prices were way above normal ratios when compared to both rents and incomes at the time.

They explained that mortgage transactions as a percentage of all home sales were also at a higher percentage:

“Loose credit was one of the main culprits of the housing crisis. Mortgage lending expanded dramatically as unhealthy housing speculation reached its peak and was met by the highest level of credit availability as measured by the Mortgage Bankers Association. The index measures the overall mortgage credit condition by the share of home sales financed by mortgages. This metric does not capture credit quality, but it does set a view of the importance of financing in supporting the housing market.”

House flipping was rampant in 2005. As realtor.com’s research points out:

“Heightened flipping activity is a clear indication of speculation in the real estate market. A property is considered as a speculative flip if the property is sold twice within 12 months and with positive profit. Flipping is a normal part of a healthy housing market. In an inflated housing market, expectations about short-term profit from pure price appreciation are very high; therefore, the level of flipping activity would show evidence of being heightened.”

Here are the categories with percentages reflecting the unrealistic ratios & numbers of 2005 as compared to the current market. Remember, a negative percentage reflects a positive gain for the market.

Bottom Line

They say hindsight is 20/20… Today, experts are keeping a close watch on the potential red flags that went unnoticed in 2005.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Tags: Davenport, Orlando Communities, orlando real estate, real estate, real estate bubbles, Teri Isner, Winter Haven, www.orlandoave.com

Posted in Celebration, Financing, General Real Estate, Homes, Kissimmee, Orlando, Windermere | No Comments »

August 5th, 2016 by tisner

![Do You Know the Impact Your Interest Rate Makes? [INFOGRAPHIC] | Keeping Current Matters](https://www.keepingcurrentmatters.com/wp-content/uploads/2016/08/20150805-Cost-of-Interest-KCM.jpg)

Some Highlights:

- Interest rates have come a long way in the last 30 years.

- The interest rate you secure directly impacts your monthly payment and the amount of house that you can afford if you plan to stay within a certain budget.

- Interest rates are at their lowest in years… RIGHT NOW!

- If buying your first home, or moving up to the home of your dreams is in your future, now may be the time to act!

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Tags: celebration real estate, mortgage interest rates, orlandoave.com, real estate, Realtor Teri Isner

Posted in About Orlando, Celebration, Financing | No Comments »

July 15th, 2016 by tisner

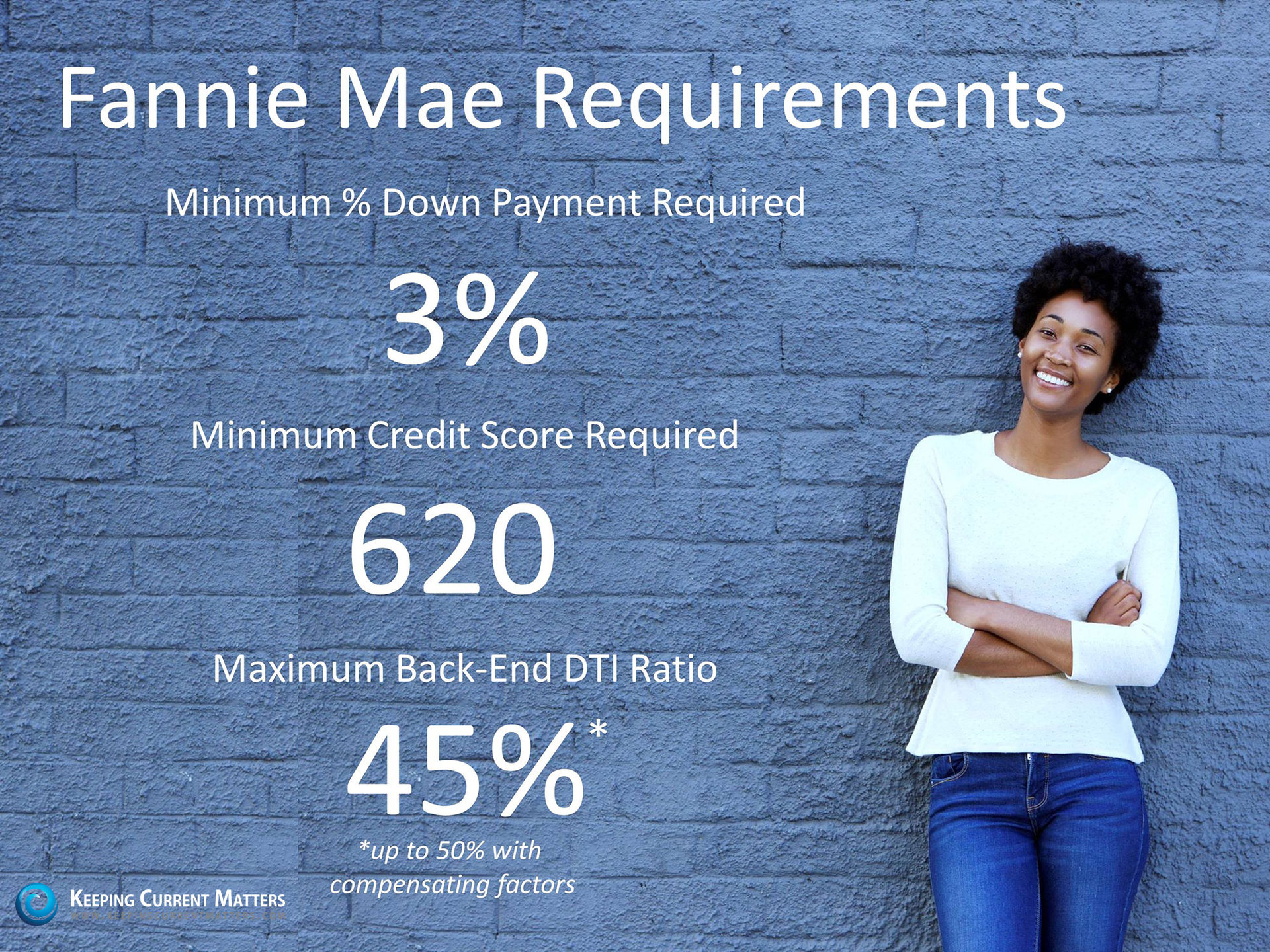

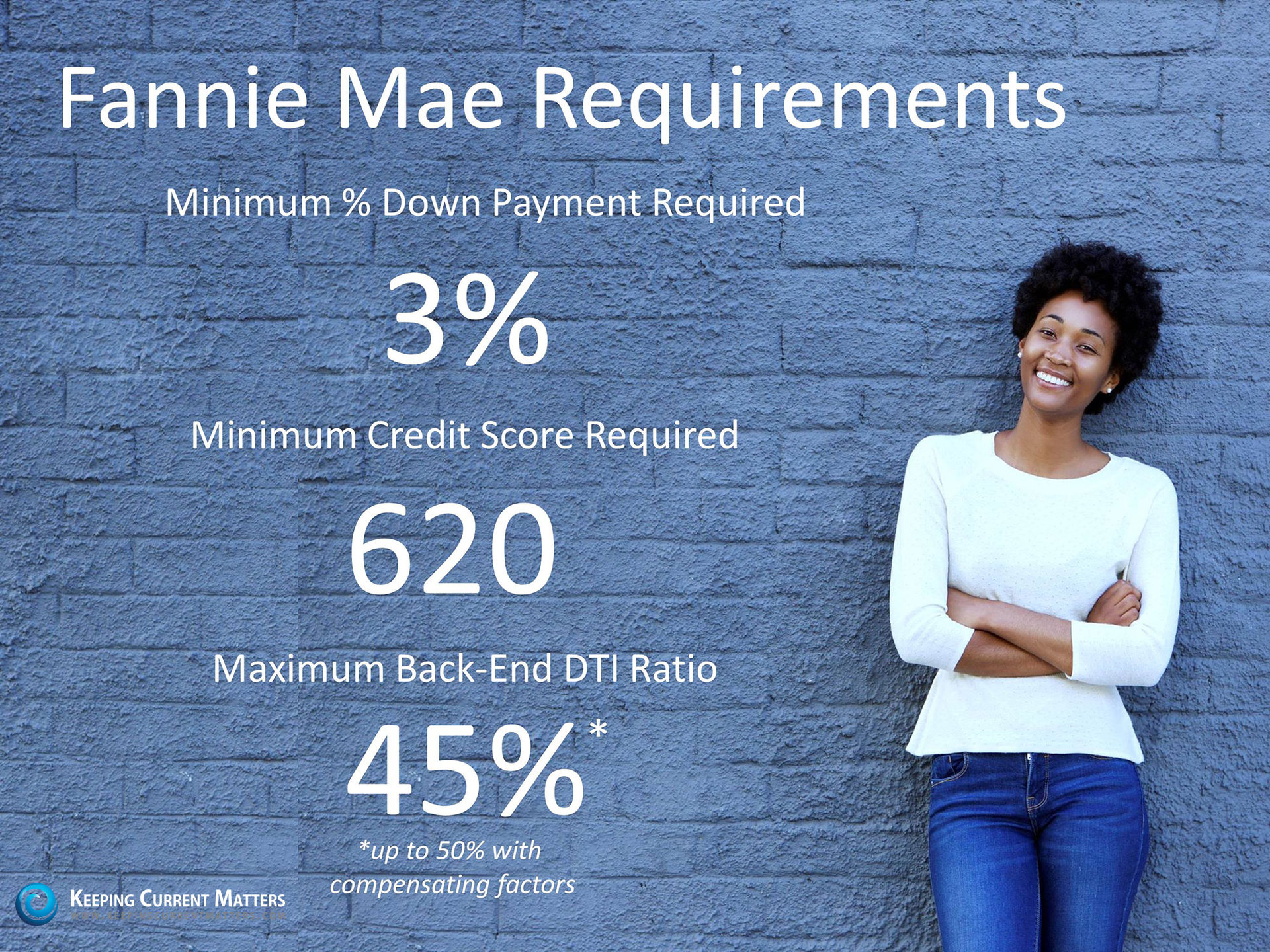

Whether you are considering the purchase of your first home or trading up to the home your family frequently fantasizes about, there are three crucial questions you must know the answer to:

-

What is the minimum down payment required to purchase a home?

-

What is the minimum FICO score required to qualify for a mortgage?

-

What is the maximum Back-End DTI Ratio allowed?

A survey conducted by Fannie Mae revealed startling information: most Americans don’t know the answer to these three crucially important questions. Here is a graphic showing the results of the survey:

The percentages are quite disturbing but can explain why so many people believe they are not eligible to purchase a home whether it is a first home or a trade-up home. Here are the actually requirements as per Fannie Mae:

Bottom Line

If you are considering purchasing a home, make sure you are aware of all your options before moving forward.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Tags: 3 questions buyers ask, home buying tips, orlando fl real estate, orlando homes for sale, orlando real estate, orlandoave.com, questions to ask when buying a home, real estate, Teri Isner Realtor

Posted in Financing, General Real Estate, Orlando Buyers | No Comments »

June 9th, 2016 by tisner

Did you know that you are entitled to a free credit report once a year from all of the major credit reporting companies? I don’t know about you but that is news to me! If you are in the market to purchase a new home and have not had your credit report pulled lately you may be happy to find this news out! By checking your credit report before you purchase a home or for any other reason for that matter you will be able to see if there is anything on your credit report that is not accurate and remove it and you may also be able to find out if you have been the latest victim of identity theft. The major credit reporting companies are Equifax, TransUnion, and Experian. If you want to get your yearly free credit report all you have to do is go to each of these sites and click on “Request Your Credit Reports”. You can also send a letter to each of the three major credit reporting companies. A few tips to follow are below.

- Be sure that if you get on a credit report website and are asked for money that you do not respond. There are many hackers out there trying to get your information and this is just one of the many ways in which they do it.

- Do not give out your social security number unless you are on a site that you know is secure.

- Check your credit report every four months or so to be sure that your account hasn’t been compromised.

- There are credit monitoring companies you can hire to keep a watchful eye on your credit report if you feel it is necessary to do so.

Again, be sure that you are not asked for any monies when trying to get your free credit report. Be assured that there are many companies out there that claim they will give you a free credit report only to ask you for your credit card information at the very last step. Step away from those companies and continue with your search until you find one that lets you leave the page without asking for any form of payment. Once you get your report you can then be on your way to making any changes needed to help improve your score. When you get your credit where you want it and where it needs to be, the world will open up to you in ways you never thought possible.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Tags: 365 Orlando, credit report, home buying tips, hot to get free credit report, orlando avenue, orlando real estate

Posted in Financing, General Real Estate, Orlando Buyers | No Comments »

May 13th, 2016 by tisner

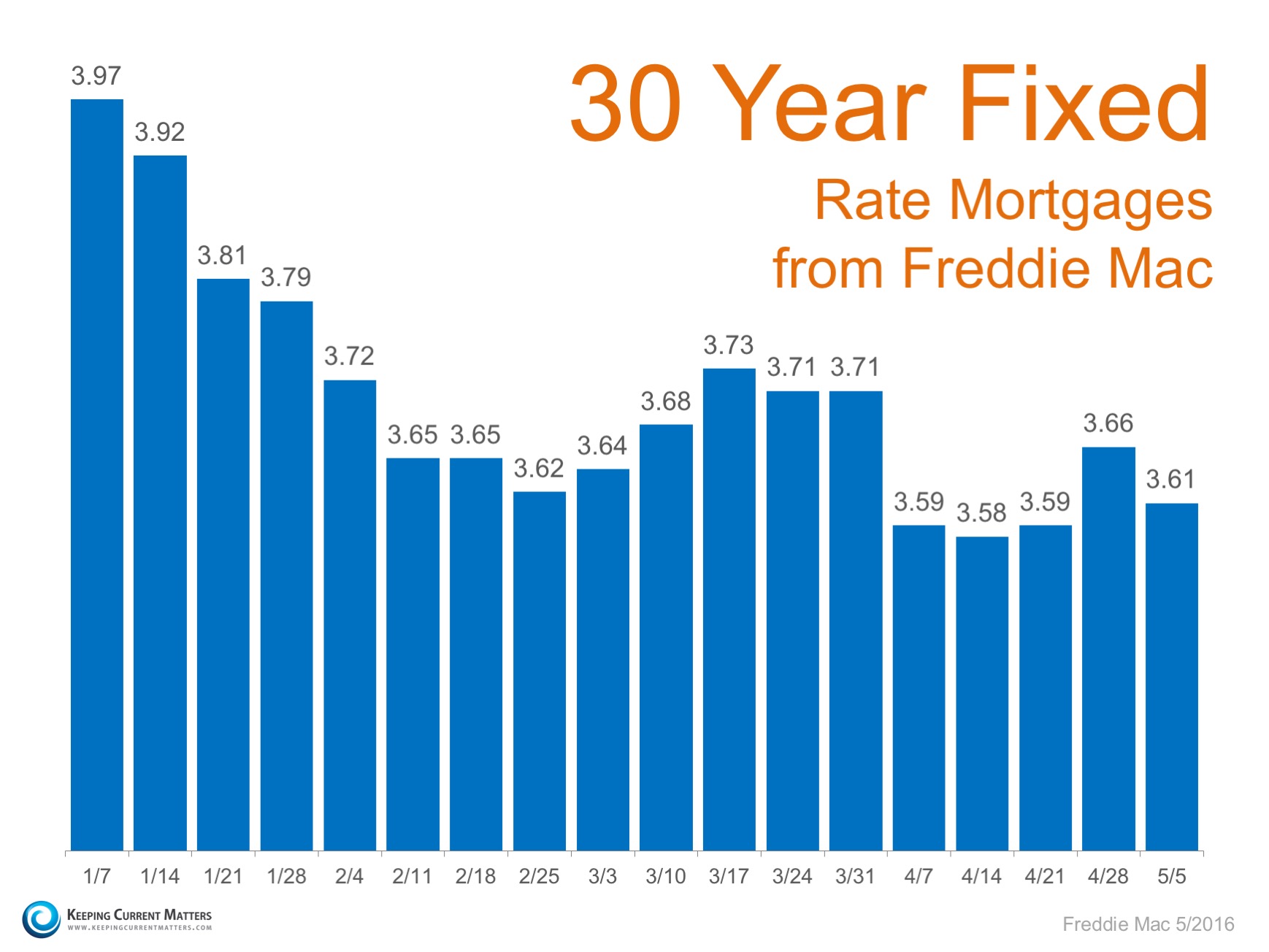

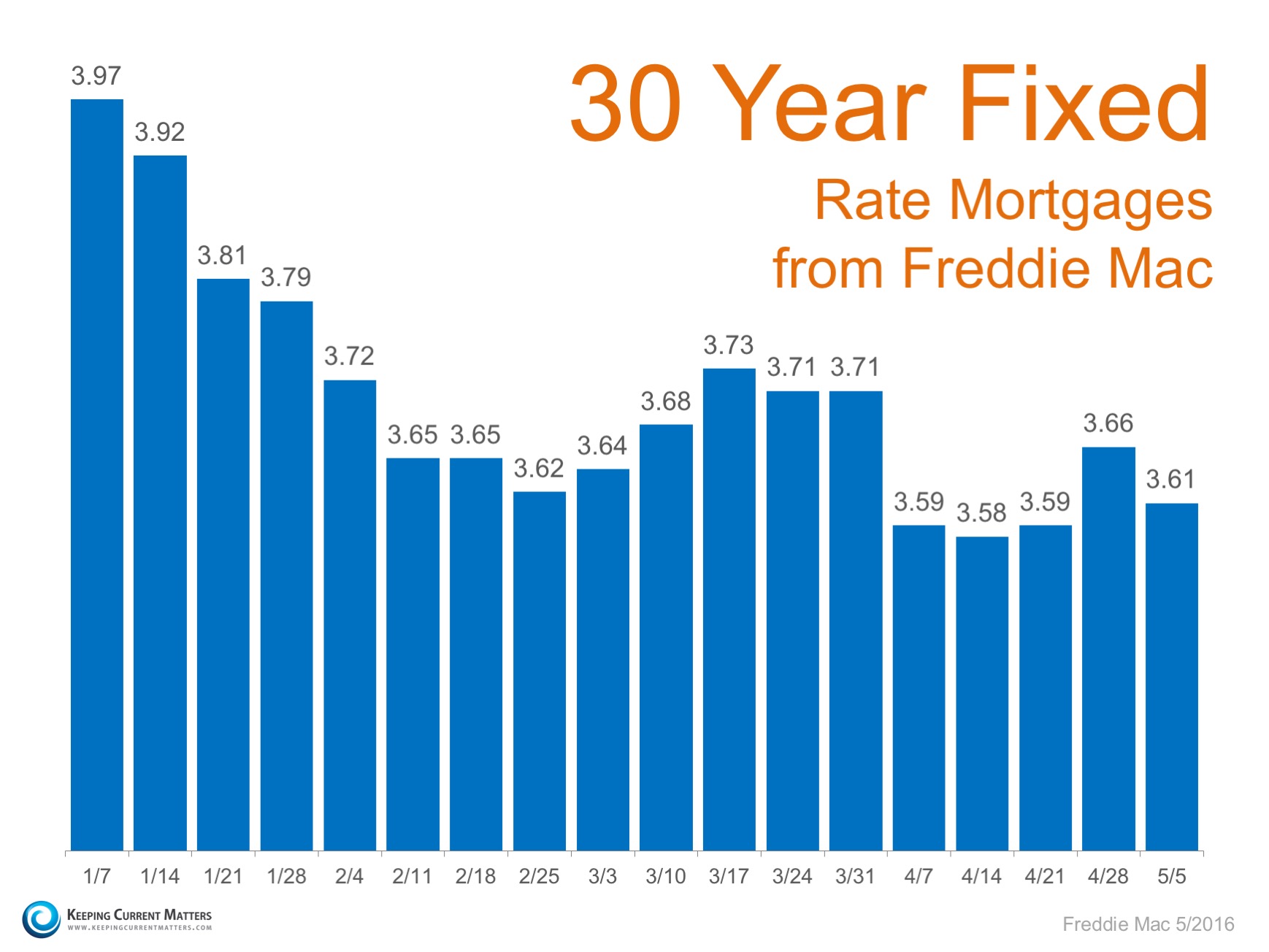

The latest report from Freddie Mac shows that the 30-year fixed-rate mortgage averaged 3.61% last week, slightly down from the week before (3.66%), and nearly 20 points lower than a year ago (3.80%). This is great news for homebuyers who are dealing with rising prices due to a low inventory of homes for sale in many areas of the country. Freddie Mac expressed their optimism for the rates to remain low throughout the spring in a recent blog post:

“We expect mortgage interest rates to stay well under 4% as we head into the heart of the spring homebuying season. We’re predicting it to be the best one in 10 years, which should provide even greater opportunities for first-time homebuyers.”

Below is a chart of the weekly average rates in 2016, according to Freddie Mac.

Rates have again fallen to historic lows yet many experts still expect them to increase in 2016. One thing we know for sure is that, according to Freddie Mac, current rates are the best they have been since last April. Sean Becketti, Chief Economist for Freddie Mac recently explained:

“Since the start of February, mortgage rates have varied within a narrow range providing an extended period for house hunters to take advantage of historically low rates.”

Bottom Line

If you are thinking of buying your first home or moving up to your ultimate dream home, now is a great time to get a sensational rate on your mortgage.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Tags: mortgage rates, orlando avenue top team, Teri Isner

Posted in Financing, General Real Estate | No Comments »

![Do You Know the Impact Your Interest Rate Makes? [INFOGRAPHIC] | Keeping Current Matters](https://www.keepingcurrentmatters.com/wp-content/uploads/2016/08/20150805-Cost-of-Interest-KCM.jpg)