Real Estate Trends: What’s the 2023 Fla. Outlook?

January 26th, 2023 by tisner

ORLANDO, Fla. – What should consumers, Realtors® and policymakers expect when it comes to Florida real estate over the next year? After the unexpectedly strong years of 2020 and 2021 despite an ongoing pandemic, Florida’s housing sector in 2022 was affected by rapidly rising inflation and higher mortgage interest rates, Florida Realtors® Chief Economist Dr. Brad O’Connor told nearly 500 Realtors during the recent 2023 Florida Real Estate Trends summit.

“Now, we expect the state’s residential real estate market to return to a more typical pace,” he said. “I believe 2023 will look more like the ‘traditional’ housing market years of 2018-2019 in Florida as supply and demand become more balanced.”

The event was part of this year’s Florida Realtors®’ Mid-Winter Business Meetings at the Renaissance SeaWorld Orlando. In addition to O’Connor, the summit featured John Leer, chief economist of Morning Consult, which uses high-frequency survey data to capture insights into consumer attitudes and concerns. Leer leads global economic research and oversees the firm’s economic data collection, validation and analysis. He is an authority on the effects of consumer preference, expectations and experiences on purchasing patterns, prices and employment.

It also included a panel of Realtors who use Florida Realtors’ SunStats resource regularly, sharing how it helps them in their business. Panelists were Peter West, broker/managing partner, Bishop West Real Estate; Kara Wisely, broker associate, Berkshire Hathaway HomeServices Florida Realty; and John J. Adams, president, Adams, Cameron and Co., Realtors. Jennifer Warner, Florida Realtors economist and director of economic development, served as the moderator.

Dr. Brad O’Connor, Florida Realtors chief economist

One major question currently on the minds of real estate professionals, homebuyers, home sellers and others: Is a price correction on the way?

“Well, prices are determined by both demand and supply,” O’Connor said. “Falling demand is only one ingredient needed for a large correction; we also need a flood of supply – in the last housing cycle, this came from overbuilding and foreclosures. And it’s unlikely that we’re going to see a flood of newly built homes on the market for several reasons. First, fewer home builders currently exist than in years past; builders are more conservative when it comes to taking on new builds; and home builds are taking longer to complete. Supply is also being affected by homeowners who don’t want to list their house and buy a different one because they’re likely to have to pay more on the next home due to higher mortgage interest rates.

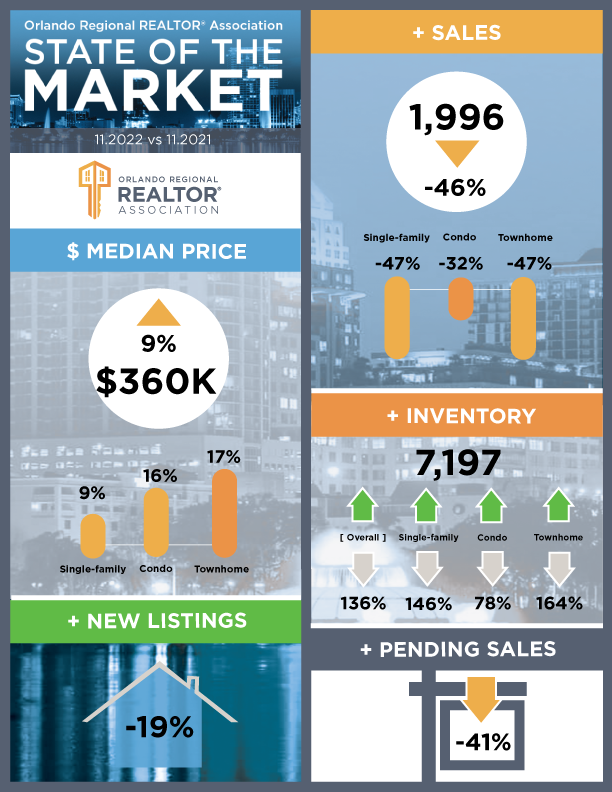

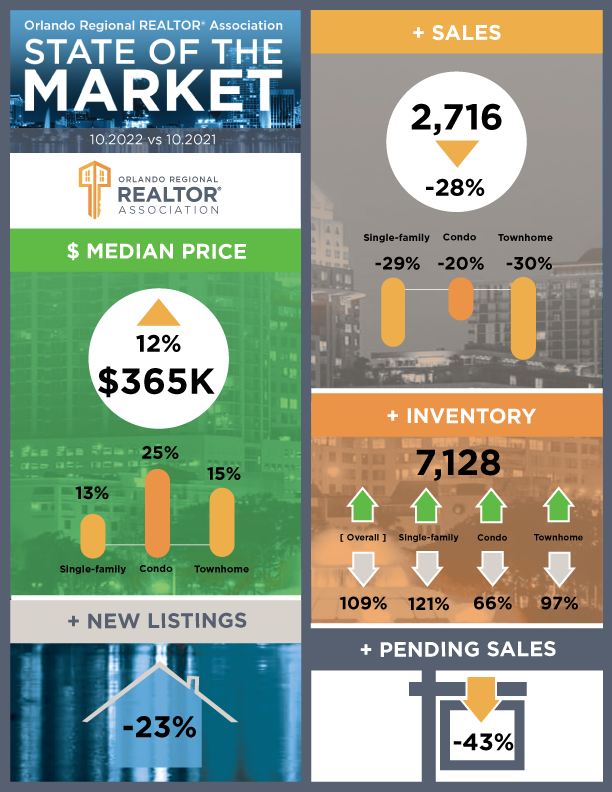

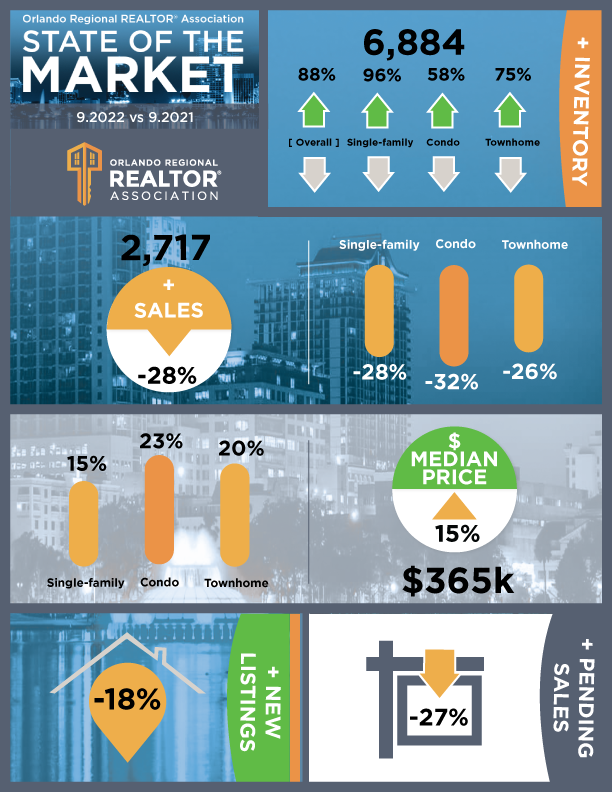

“So it’s true some owners are feeling ‘locked-in’ to their current home and current mortgage rate, but it’s not all homeowners. We are seeing gains in inventory (active listings) and closed sales are continuing. And we are going to see some relaxing or easing in prices, but we’re not going to see a great drop unless or until we see more supply available.

According to O’Connor, inflation will continue to be a factor in 2023, though recent economic news shows the Federal Reserve’s action to fight inflation appears to be having a positive effect. Buyer demand in Florida in the coming months will continue to be challenged by insurance costs, mortgage rates – especially if rates start rising again to 7% or higher – and ongoing economic uncertainty that erodes consumer confidence.

“Mortgage rates will come down, but it’s all dependent on different factors,” he said. “All of the current forecasts on existing home sales in 2023 rely on where the 30-year mortgage rate is going to be, and that’s in flux.

Recent 2023 forecasts for U.S. existing home sales compared year-over-year to 2022 include:

National Association of Realtors® (12/13/22): Existing home sales fall 7.0% Y/Y in 2023

Fannie Mae (12/12/22): Existing home sales fall 21.1% Y/Y in 2023

Mortgage Bankers Association (12/19/22): Existing home sales fall 13.7% Y/Y in 2023

Redfin (12/6/22): Existing home sales fall 16.0% Y/Y in 2023

Realtor.com (11/30/22): Existing home sales fall 14.1% Y/Y in 2023

National Association of Home Builders (1/4/23): Existing home sales fall 15.7% Y/Y in 2023

O’Connor said, “In the first half of this year, I feel confident that we’re going to see home prices flatten out on average, and I think sales will kind of hug below the line of 2018 (closed existing home sales). I expect closed sales to hover a bit below the more usual pace of Florida home sales, such as what we saw in 2018. However, because home prices are much higher now than in 2018, we are still going to see a higher dollar volume of closed existing home sales, just not at the level of last year or in 2021 with dollar volume.”

Dr. John Leer, Morning Consult chief economist

How consumers are affected by the economy, inflation and other factors – or how they feel about what’s going on in the world around them – influences consumer confidence and factors into their buying decisions or saving habits, according to Dr. John Leer, chief economist for Morning Consult.

“In 2023, consumer confidence is starting to rise across most of the U.S. but remains far off from where it was a year ago,” he said. “It’s going to take a prolonged period of real wage growth and fairly stable policy outcomes for consumers to feel more comfortable and confident about the economy and their future. In December, consumers reported rising credit balances at the highest rates since tracking began. Research shows more consumers are finding it difficult to make ends meet at the end of the month, and the share of adults able to save each month continues to shrink.”

Leer pointed out this is a sign that consumers have been pushed to the brink and are having to pull back on spending as higher expenses erode their savings and sense of financial stability.

“While we’re seeing in the news that inflation is starting to cool, inflation is still impacting consumers,” he said. “They still feel and see that inflation is costing them more. Consumers are under financial stress and they’re trying to downsize their spending. Over the last two months, what we’re seeing is the outlook for the U.S. economy has really deteriorated, particularly among consumer fronts. Consumers have exhausted their sources of spending. We expect to see consumers continue to draw back from spending as small business and other sectors reduce hiring, expenditures and otherwise also contract.”

However, Leer also noted that housing and homeownership remain a top priority for many consumers. “Housing prices are beginning to flatten but continue to resist declines as buyer interest perks up,” he said. “Buyers are still waiting in the wings, interested in purchasing a home as soon as they’re able to do so financially. We continue to see that homeownership remains a strong goal for consumers, particularly for young adults looking to start a family and who feel secure in their jobs and ready for that next transition.”

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

By and photo credit: www.floridarealtors.org