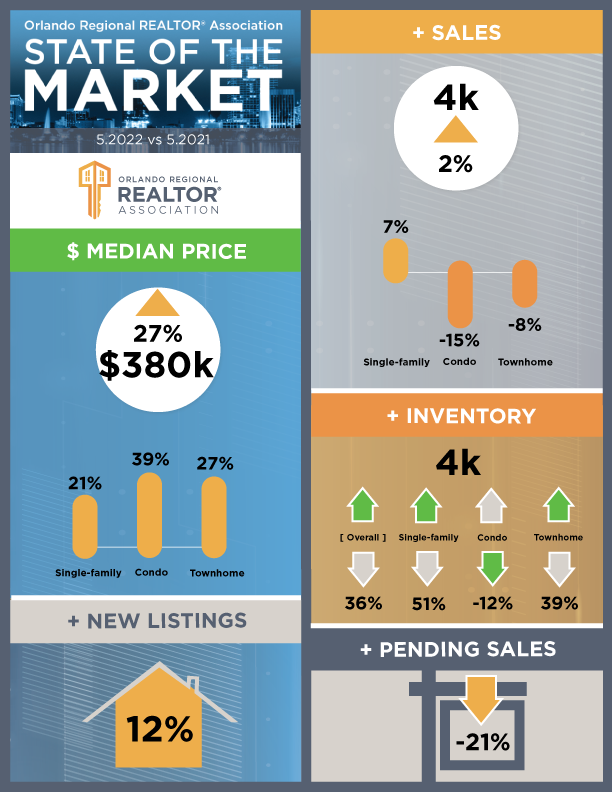

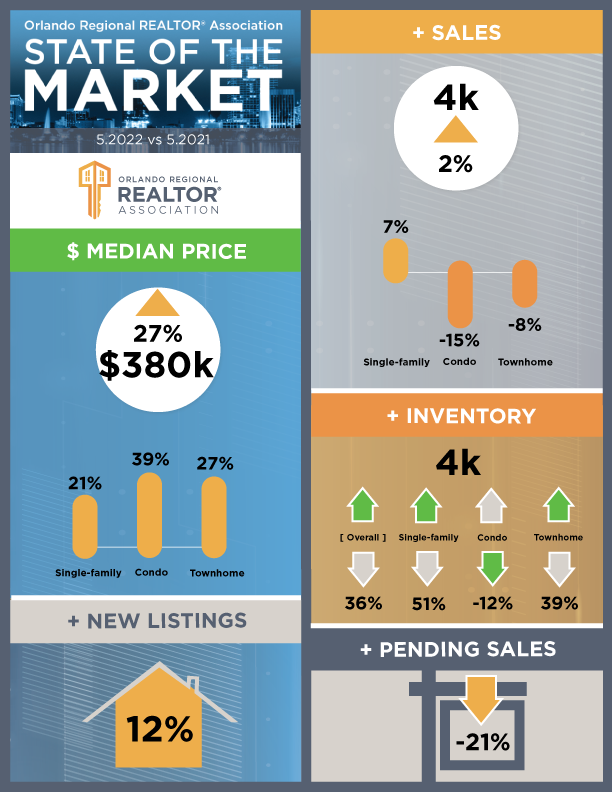

Orlando State of the Market May 2022

June 16th, 2022 by tisner

|

|

Like what you have been reading here? Subscribe now and receive email updates of our articles.

|

|

Searching for the right mortgage for your new home is likely the most important step when buying a new home. Having that preapproval lets you know how much house you can afford as well as getting your wallet ready for budgeting. There are some things you can do that can make lenders second guess your application, and you want to avoid doing anything that can sabotage the purchase of a new house:

Lastly, buying a home without a REALTORⓇ can be a costly mistake. No, there is no money coming directly from your pocket to pay the buyer agent–their pay comes from the home sale. Find a reputable agent who knows how to find the right house for your budget as well as your wants and needs, plus knows all about negotiating a home sale price.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Photo credit: CNBC

Putting a home on the market can be a stressful experience. Sometimes it seems like homes sell almost before you can get them listed, while others appear to languish due to shifts in the economy and buyer enthusiasm. Fortunately, there are ways that you can increase the likelihood of your home selling even if the market isn’t at its best. One of these options is to improve your home staging so that potential buyers will be wowed by the property and want to make it their own.

Some people view home staging as simply making sure that everything is neat and orderly so that buyers can see the home at its best. While this is important, it’s not the only thing that you can do to improve the appeal of your home. Here are a few unexpected ways that you can make your home look better to prospective buyers.

When staging your home, you want to make sure that you not only present its best qualities but that you also reduce the impact of some of its less-great aspects. Take your bathrooms for instance. If one or more of the bathrooms in your home seem kind of small, try putting a larger bathroom mirror in there to make the whole room seem bigger. Also, hang it slightly lower if possible so that you don’t have a large mirrored surface looming over visitors’ heads; ideally, the center of the mirror should be slightly below eye level for the average person using it.

Another tip that can work in both bathrooms and any room that seems a bit too dark is to lighten up the walls to improve the overall brightness of the room. This can be as simple as replacing dark colored curtains with light white ones or adding white hand towels and decorative items to add light areas to the room. If you feel like taking in a larger project, add a couple of coats of paint in a light color that goes well with existing decorations, such as a light blue or soft light green.

Tweaking your furniture and decorations is another way that you can improve your home staging and make your home a must-buy. If you wish that you had some more upscale furniture to show off, talk to developers that have model homes available in planned communities around where you live. Much of that furniture is used solely for staging, and excess pieces can usually be bought relatively cheaply since they’re considered used. Staging companies in your area may also have furniture available for rent or purchase under similar terms. The best part is, if you buy the furniture for your staging then you may be able to recoup some of your money by selling the furniture along with the house.

While you want buyers to like the way that your home looks, it’s also important that they think it looks comfortable and ready for them to move in. Add fluffy comforters and knit throws to beds, drape a soft blanket along the back of the couch, and add other little touches to make it look like the house is just waiting for someone to make it theirs. Just be sure that you remove photos and other personal items from the home before the staging since you want potential buyers to picture it as their house and not yours.

One last thing that you can do to improve your staging is to go ahead and finish some of the little repairs around the house that you never quite got around to doing. If you need a handyman or contractor to help, HomeKeepr can hook you up. Creating a HomeKeepr account is free, and you can use our app to connect with pros in your area to take care of the little repairs and improvements that will really help take your home from being on the market to being sold.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

By: Homekeepr, Rob Morelli

While meeting with a lender to discuss the purchase of a new home, you may hear and read words you are not familiar with. Knowing these financial terms and acronyms will make that meeting go more smoothly. Here are some common financial terms that will come up during your mortgage transaction:

Do not go into the lending process without some knowledge under your hat! Going into what is probably your largest investment without knowing anything about it may end up in disappointment and having to wait longer to buy your new home. The Consumer Financial Protection Bureau offers many other terms not listed here and is a great resource for learning more.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Photo credit: bettermoneyhabits.bankofamerica.com

The appraisal is one of the many steps in the buying/selling transaction. Lenders need an unbiased valuation of the home being sold, and the appraiser will look at the property. Sellers generally have at least two weeks to get ready, and because they have an important stake in the appraisal of their house, they should be well prepared:

Exterior

Interior

Repairs that cost $500 or less are worth making, as they usually add to the appraisal value. Allow the appraiser to perform their job, answering questions along the way, and have any paperwork from previous repairs at the ready. After prepping the house for the market, it is important to maintain it during the showing process, as it will save time and money once an offer is made and the appraiser makes their assessment.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Photo credit: houselogic

Finding the right loan to meet your needs can be one of the hardest parts of buying a new home. There are a number of mortgage options out there, and if you choose one that isn’t really ideal for your situation, then you might end up paying a lot more for it in the long run. With so many options, though, how do you know that you’re getting the best loan to match your situation?

It might take a little bit of homework, but there are actually a few different ways to sort through potential loans to find the best one for you. A lot of things can affect the loans that are available to you, including where you live, what your credit history looks like, and even the state of the economy. With that said, here are a few things that you should keep in mind when shopping around for loans to help ensure that you get the loan that best meets your needs.

Getting a good interest rate on a mortgage loan is obviously a big concern for most potential buyers, since even a small difference in interest rates can result in large savings when choosing between two mortgages. This is one of the big reasons that it’s recommended that you shop around for your mortgage, comparing quotes from a few different lenders to find the one that offers you the best interest rate. The rate alone isn’t the only thing that you need to consider when comparing loans, though.

Interest can take multiple forms on mortgage loans. Fixed-rate loans lock in a single rate for the entire repayment period, while variable-rate loans can change over time (usually once per year and with the amount of change capped, but the exact details can differ between loan providers). Some mortgages even act as a hybrid between these two, locking in a low rate for a specific period and then changing it after that period has ended. Understanding the type of interest that a mortgage features and how it will work over the course of the loan can help you avoid unexpected payment changes down the line.

The term of your mortgage is another thing that you should pay careful attention to, since it can affect both your monthly payment and the amount that you pay in interest over time. Longer-term loans may cost you more in the long run, especially if you have a loan that will increase in interest over time. Likewise, shorter-term mortgages can save you money in interest, but might be harder to pay each month due to a higher overall payment. You should also watch out for loans that only have you pay against interest during the first part of the loan’s term; this starts you off with a low monthly payment, but isn’t reducing the amount that you owe at all until the payment increases.

There are other mortgage considerations that you should keep in mind as well. Most mortgages will require you to cover a portion of the property being purchased in a down payment, and the down payment amount can vary significantly between lenders. Different loan programs such as loans secured by the FHA can reduce this and some other costs as well. Just be sure to do your due diligence in exploring your loan options first.

The key to finding the mortgage that’s right for you is finding lenders that you can trust. Fortunately, HomeKeepr can help you with this. Our app can connect you with lenders and loan professionals so that you can compare offerings and secure the best mortgage that you can find. Creating an account is free, so sign up today and get started in your hunt for the perfect mortgage loan. Your dream of becoming a homeowner is just a few steps away!

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

By: Homekeepr, Rob Morelli

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Stats courtesy of StellarMLS

Additions can be a good way to get more functionality out of your home. Your addition might be an extra bedroom for your expanding family, a home office to provide you with a space to work from home, or even a sunroom or hobby area. Your add-on might even be a way to add more space to existing rooms, removing or extending walls to let your current kitchen, bedroom, or other area flow seamlessly into your new addition. There are just so many possibilities.

Regardless of what you plan to use the room for, though, adding on to your house is a big undertaking and may be kind of a big investment as well. Even relatively small additions can be a big project, so it’s important that you know exactly what your plans will entail before you start work on expanding your home. To help with this, here are a few things to consider when making plans to add on to your home.

Though you may have a good idea of where you want your addition to go, it’s important to spend some time actually planning it out. Consider details such as where the property line is located, whether there are any size or location restrictions based on state and local building codes, and whether there will be issues with the location of utilities or the slope of your property that could cause problems. Taking the time to rule out potential problems with your addition now will save you a lot of headaches down the road.

Another thing to keep in mind is how well your addition will combine with your existing home. While you obviously have a good reason to want more square footage, if you just have an added room tacked awkwardly onto your home, it can have a major impact on your home’s overall value. A good addition will blend seamlessly into your existing home, matching the exterior and making it difficult to tell that an add-on was made down the road.

Depending on the sort of addition you want to make, the budget for your add-on can fall within a pretty wide range. It’s very important that you spend some time researching exactly what it will take to make your expansion plans a reality. The time of year, materials costs, and factors such as the size and types of materials you choose will all affect how much you’re going to have to spend. Taking the time to do a bit of research and consult with your contractor about the options available to you can end up making a big difference in the final cost of your expansion.

This is important not just because of the immediate impact to your pocketbook, but also the overall difference that it makes on your home’s value. All the money that you put into your addition is an investment in your home, and you want to get the biggest return on that investment that you can. Making smart choices and not letting your budget balloon out of control will go a long way toward maximizing your home’s value in comparison to the cost of your add-on. It’s more work now, but you’ll be thanking yourself if you find yourself wanting to sell your home at some point down the road.

Choosing the right contractor is one way that you can affect the overall cost of your addition and maximize the return on your investment. HomeKeepr can help you with this, matching you with contractors and other pros in your area based on real recommendations from people that you already know and trust. Best of all, creating a HomeKeepr account is free. Sign up for an account today and get started finding the right professional to make your expansion dreams come true without breaking the bank.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

By: Homekeepr, Rob Morelli

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

There are a number of trends in home decoration that you’ve likely seen come and go over the years. Some of them look pretty nice and create something of a timeless look, while others… well, it’s pretty easy to understand why they’re only temporary trends. Like them or hate them, though, following home trends can sometimes have a positive impact on the value of your home if you’re looking to sell. That is, of course, if you strike while the iron is hot.

But what if you’re not actually looking to sell at the moment and just like the way that a trend looks? Will going all-in on some big trend hurt your home’s value down the line if you do decide to sell later? This could be a legitimate concern depending on the trend. After all, even if you’re on the market and don’t manage to sell right away, you could find that going too far with certain trends will bite you before you find a buyer.

There isn’t necessarily anything wrong with following home trends, either to bump up the value of your home in the current market or just because you like the look of them. If you’re thinking of making some changes around the house because of a current trend, here are a few things to think about:

Don’t be afraid to make some changes and upgrades in trendy styles, but don’t go overboard with it. This is especially true if you’re just looking to make some trendy home improvements before you sell your home.

Some trends can really bring up the value of your home if you catch them at the peak of their popularity, but if you aren’t that lucky, then they can cost you money in the end. These are the trends that you should avoid unless you really like them. Here are a few things to look out for when considering home trends:

Basically, trends can be fun. Think twice about them though if they’re going to be too expensive, create too many headaches for future homeowners, or are likely to come across as garish or ugly.

If you do want to make some home improvements or other changes to follow certain trends, it’s important that you find the right pro for the job. Whether you need an interior designer, a painter, or even a plumber to help you follow a new fountain trend, you don’t want to pay more than you have to. HomeKeepr can help with this. Sign up for a free account today and connect with the pros in your area who can get the job done without breaking the bank.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

By: Homekeepr, Rob Morelli

Teri Isner, CIPS, CRS, GRI

Keller Williams At-The-Lakes

700 Celebration Blvd

Suite 300

Celebration, Fl 34747

This site is proudly sponsored by Orlando FL Real Estate Kissimmee and Celebration

Copyright © 2026 Orlando FL Real Estate Kissimmee and Celebration | All Rights Reserved. Sitemap