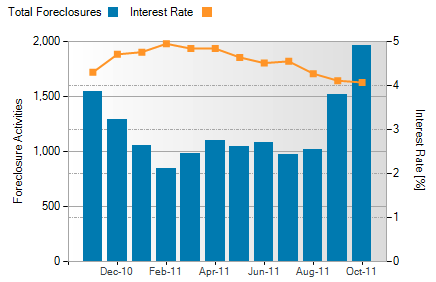

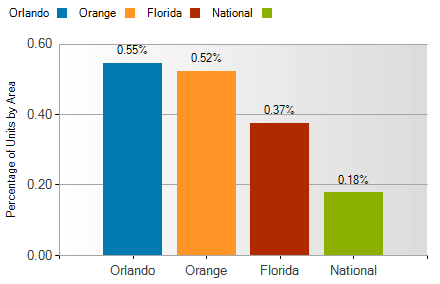

Orlando was among cites showing a slight decline in home prices in September. The decrease of 1.4% was among the lowest decrease recorded in cities being tracked during the month. With continued record foreclosure sales amid a weak economy and tight underwriting standards that continue to constrain housing demand, home prices are expected to remain weak despite low interest rates and renewed government efforts to keep people in their homes. FNC’s latest Residential Price Index™ (RPI), released Monday, indicates U.S. home prices decreased as expected in September, consistent with weak housing activities reported for the month. The trend marks the second month of price declines after a relatively robust summer home-buying season.

Based on the latest data on non-distressed home sales (existing and new homes), FNC’s RPI shows that single-family home prices fell in September to a seasonally unadjusted rate of 0.4%. As a gauge of underlying home value, the RPI excludes sales of foreclosed homes which are frequently sold with large price discounts reflecting poor property conditions. The RPI is the industry’s first hedonic price index − built on a comprehensive database blending public records with real-time appraisals of property and neighborhood attributes. By modeling observed sales prices as being determined by property and neighborhood attributes, one of the key advantages of the RPI is its ability to capture intrinsic home price trends.

Two broader RPI indices (the National and 30-MSA composites) showed month-to-month declines in September at 0.4% and 0.2%, respectively. Although both indices mark a second month of price weakening, smaller declines were realized in September when compared to the August measures. Meanwhile, the 10-MSA composite index showed a small uptick from the previous month. On a year-to-year basis, home prices are about 3-4% lower than September 2010.

In addition to Orlando’s 1.4% decline, several other metro areas tracked by the FNC 30-MSA composite index, also recorded weakened prices in September, including Charlotte (-1.8%), Cleveland (-1.6%), Las Vegas (-1.6%), Tampa (-2.4%), Sacramento (-1.5%), San Francisco (-1.4%), and Miami (-2.8%). Growth momentum in Detroit, which has seen prices rising consistently month over month since April for a cumulative total of 9.4%, subsided in September and prices were flat during the month. In Chicago, home prices enjoyed another strong rebound: up 3.1% from the previous month following August’s 2.8% increase. On average, Chicago home prices rose 3.0% during the third quarter.

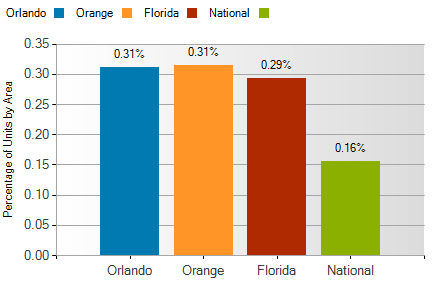

Year to date, Boston, Houston, Detroit, San Antonio, Minneapolis, and Chicago are among those showing the best price appreciation, up 6.0%, 5.4%, 4.2%, 4.2%, 3.8%, and 3.7% respectively. Foreclosures sales and the glut of foreclosure inventory continue to depress the Miami, Las Vegas, Orlando, and Tampa markets, where prices are down 8.5%, 8.3%, 6.6%, and 6.2%, respectively, year-to-date.

Year to year, Orlando, Las Vegas, and Tampa continue to lead the nation in annual price depreciation in double digits, down 14.4%, 13.0%, and 11.6%, respectively. Only two cities − Boston and Detroit − showed modest annual price appreciation, with home prices rising 2.2% and 2.0% in the last 12 months. As of September, home prices in San Francisco and Chicago also remain slightly higher than a year ago.

Information courtesy of:

Seth Klein Marketing Production Coordinator

Phone: (662) 236-8277 ▪ E-mail: sklein@fncinc.com

FNC Inc. ▪ 1214 Office Park Drive ▪ Oxford, MS 38655

www.fncinc.com<http://www.fncinc.com/> ▪ www.collateralvision.com<http://www.collateralvision.com>