June 30th, 2022 by tisner

Having a good HVAC system in your home can really help you enjoy your living space throughout the year. A solid system will keep your home cool in the summer, warm in the winter, and just plain comfortable throughout the full year. Proper maintenance can keep your HVAC system running smoothly for years, ensuring that your home’s internal climate stays exactly the way you want it as time goes by.

This doesn’t mean that things can’t be better, though. You may not realize it, but there are actually several ways that you can modify your HVAC system to improve performance and create a better overall quality of life for you and your family. Different systems may have different options available, and they can affect the function of your system in different ways.

Air Purity Add-Ons

Some of the most common HVAC modifications are designed to improve the overall quality of the air in your home, filtering out impurities and eliminating things in the air that could possibly make you sick. Air cleaners and air purifiers are readily available for a number of systems, trapping things as small as bacteria, viruses, and allergens that are too small to be seen by the naked eye. These function similarly to portable single-room air purifiers, but instead of only working on the room where the unit is located, these actually filter and purify the air in your entire home.

Another option that often goes along with air purification is UV lamps that treat air as it moves through your HVAC system. This high-intensity ultraviolet night kills bacteria, mold, and other organisms that might be in the air and moving through your vents. Not only does killing these organisms help to keep you and your family healthier, but it can also prevent them from multiplying and clogging your air filters over time. This helps to ensure that your air stays clean for longer and keeps your system running with peak efficiency.

Air Quality Add-Ons

Simply cleaning the air isn’t the only way that you can improve your home’s air quality. Depending on where you live, humidifiers and dehumidifiers can go a long way toward making people comfortable within your home. Air that’s too humid can lead to unchecked mold and bacterial growth, while air that’s too dry can trigger symptoms of asthma and various allergic reactions. Adding a humidifier or dehumidifier as appropriate helps to eliminate these issues without requiring room-to-room solutions.

Another way that you can improve the quality of your home’s air is to add a ventilator unit to your HVAC system. These units facilitate the exchange of stale air from within the home with external air to help eliminate odors and other forms of internal pollution and ensure that you always have fresh air within your home. Much of the external air is pretreated before it enters the HVAC system, allowing you to exchange air without introducing issues such as unwanted heat or accidentally cooling the house more than desired.

HVAC System Modification

It’s worth noting that not all add-ons will be available for every HVAC system. Some are designed with extensibility in mind, while others are more closed systems that are harder to modify with add-ons after installation. It’s a good idea to bring in an HVAC pro for a consultation when planning modifications to your system, since they’ll have a better idea of what options are available and which will give you the biggest bang for your buck.

On the plus side, HomeKeepr makes it easy to find exactly the professional you need to explore your options and help your HVAC system do more. Our app lets you connect with HVAC pros in your area who have the skills and expertise that you need and who can get the job done without breaking the bank. Creating a HomeKeepr account is free, so sign up today and get connected. Your HVAC system will thank you for it.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

By: Homekeepr, Rob Morelli

Tags: Orlando Sellers

Posted in Home Tips from Teri, Orlando Buyers | No Comments »

June 23rd, 2022 by tisner

Maybe you’ve just moved into your new home and you’ve got a patio of your very own for the first time, or maybe you’ve had one for a while and just didn’t know what to do with it. Patios are magnificently flexible spaces, if not a little boring by themselves. Think of your patio as a three-dimensional canvas that you can literally create anything on that you’d like. From tiki hot tub paradise to casual outdoor dining space, patios are only limited by your imagination. Here are some things to think about when you’re trying to dress yours up!

Lights, Camera, Action!

Patios are great, but nighttime patio lighting is often lackluster. For patios near the house, many people rely on a single bulb hanging near the back door, and those floating on the lawn may have no lighting whatsoever! It’s understandable, since there was once a time when your only outdoor lighting options were hardwired, and that was tricky with a cement slab.

But today’s patios have so many more options. Not only are solar lights affordable and reliable, they’re also amazingly diverse. Want a bit of a beach party mood? Add a whole collection of solar-powered string lights with round bulbs. Looking for something more romantic and period? Victorian-themed solar wall sconces can evoke a real mood. Add poles to elevate your lighting for even more flexibility in placement.

Fun in the Shade

Sure, the sun is awesome, but have you tried the shade? The shade is great, especially on a sunny day when the entire world is just a little too hot and a little too bright. Shades can also protect dining areas from debris that might fall from nearby trees, making dining outdoors a true pleasure.

Shade sails are easy to install, come in lots of fun colors, and lend a super modern look to all kinds of spaces. If you want something a little more serious and a lot more fancy, aluminum pergolas with shade systems can be attached to your patio or home permanently. These often have shades that can be opened or closed to let the sun in – or not – as your heart desires. Some even come with curtains to create a more private space.

Roll Out the Carpet

Outdoor rugs are increasingly diverse and must-have patio items to accompany outdoor living furniture and tables. These rugs can be heavy duty, with similar quality to rugs you might choose to have inside your house. A huge range of patterns and colors can help you create the atmosphere you’ve been dreaming of.

Using an outdoor rug can help keep your patio looking cleaner, as well as define specific spaces if your patio is larger and has a few different activity areas. You might color-coordinate one under your patio dining set (set beneath your new pergola, of course), and add another to the set of patio furniture near the hot tub to encourage people to stop and have a chat.

Add a Touch of Green

Of course, your patio is almost certainly already near plants, but there’s a whole different mood that comes with potted plants on a patio. You can tell so much about a space by how potted plants are chosen and the kinds of pots they’re in. Sleek and modern areas might benefit from simple, upright foliage plants in tall, narrow pots. More traditional spaces could go full cottagecore with some old wash tubs overflowing with your favorite annuals.

If Your Vision Is Lacking…

It’s ok! We’re here to help. Just log into HomeKeepr and ask your community for a recommendation for the very best outdoor space designers in your area. They’re just a click away and you never have to pay for a chance to make that connection for your home. Don’t have a patio yet? We can help with that, too! Just ask your community for help with a new patio installation and before you know it, you’ll be picking out your own patio theme.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

By: Homekeepr, Rob Morelli

Tags: Orlando Sellers

Posted in Home Tips from Teri, Just for Fun, Orlando Buyers | No Comments »

June 16th, 2022 by tisner

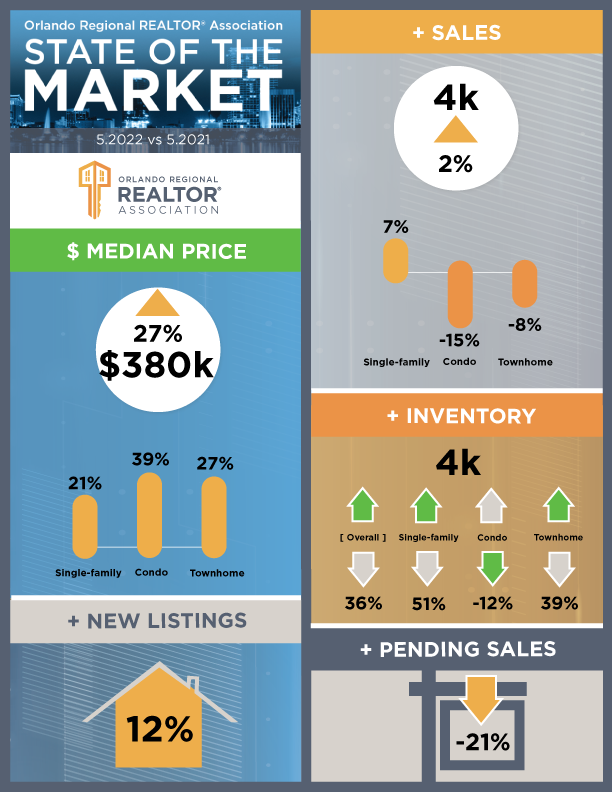

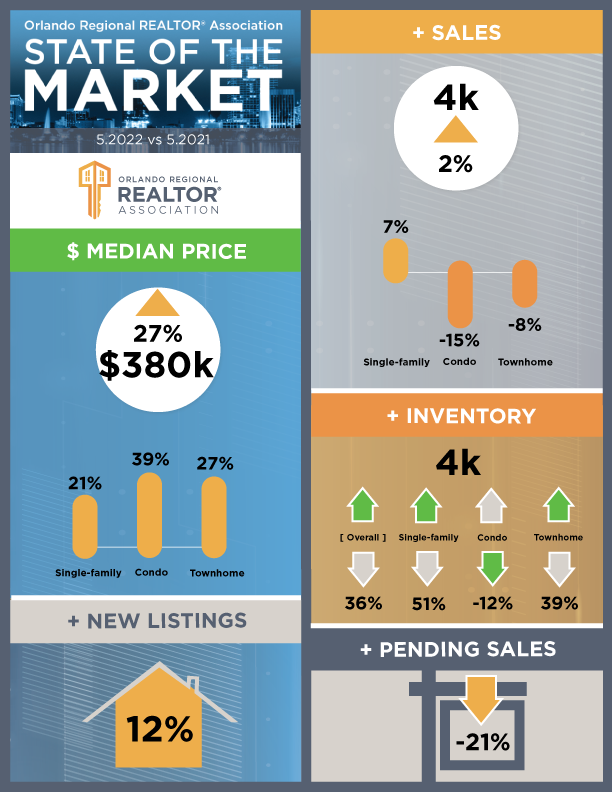

Orlando Area Residential Real Estate Snapshot for May- 2022

|

|

State of the Market

- Inventory increased by 44.2% from April 2022 to May 2022, with over 1200 additional homes hitting the market in May compared to April – this is the highest monthly increase in Orlando inventory to date

- May’s median home price was recorded at $379,950, an increase of 2.7% compared to $370,000 in April 2022; this sets a record high for the fourth month in a row.

- Interest rates increased from 4.9% in April 2022 to 5.3% in May 2022. This is the highest interest rates in the Orlando area have been since 2009. This is also the first time Orlando’s interest rates have gone above 5% since April 2010, when they were recorded at 5.1%.

- Overall sales in May increased by 3.8%, with a total of 3,946 sales compared to 3,800 sales in April 2022. This is a 1.9% increase compared to May 2021 when overall sales were recorded at 3,872.

- Homes spent an average of 21 days on the market in May, down 12.5% from April 2022 when the average was 24.

- New listings increased by 10.7% from April 2022 to May 2022, with a total of 4,822 new homes on the market in May.

- “This new surge in inventory is a sign that the Orlando housing market is beginning to level out, which is good news for both buyers and sellers,” said Tansey Soderstrom, Orlando Regional REALTOR®Association President. “Buyers will find more homes to choose from and sellers are still getting top dollar as Orlando’s median home price continues to rise.”

- Market Snapshot

- Interest rates continue to increase as the average interest rate for May 2022 was recorded at 5.3%. This is a significant rise compared to May 2021 when interest rates were at 3%.

- Pending sales decreased by 7.9% from April 2022 to May 2022 for a total of 4,645 pending sales.

- 24 distressed homes (bank-owned properties and short sales) accounted for 0.6% of all home sales in May 2022. That represents a 7.7% decrease over April 2022, when 26 distressed homes sold.

- Inventory

- Orlando area inventory increased by 44.2% from April 2022 to May 2022 from 2,670 homes to 3,851 homes. Inventory in May 2022 was 36.5% higher than in May 2021.

- The supply of homes remained at nearly one month in May 2022. A balanced market is six months of supply.

- The number of new listings increased in May 2022 from April 2022 by 10.7% to 4,822 homes.Access Teri’s one-stop Orlando FL home search website.Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

|

|

Tags: housing market updates, Orlando Sellers

Posted in General Real Estate, Housing Market Stats, Orlando Buyers | No Comments »

June 9th, 2022 by tisner

As spring turns to summer, one thing that unfortunately comes along with that change is summer storms. For some people this means frequent downpours or heavy rains. For others it means lightning or the possibility of severe weather. Even for those who don’t live in areas that commonly experience tornadoes or other severe weather, there is still a possibility of damage from things like flooding and high winds. Whether storms are a common occurrence where you live or only infrequent, keeping your home safe during bad weather should still be a concern.

You’ve likely already seen suggestions for how to stormproof your home and stay safe during inclement weather. To make sure that you’ve covered all the bases, here are a few additional ways to stormproof your home that you might not have thought of.

Stormproofing Your Property

There are a few changes that you can make to your property that may significantly reduce the likelihood of storm-related damage to your home. One big thing that you can do is inspect any trees on your property before storm season, and again in the fall to make sure that there aren’t any dead or damaged limbs that could break under pressure. Getting these removed will not only make your trees look better, but will also help protect against home damage or injury from falling limbs.

If your home is on a downward slope or located in a low area, you might also consider installing French drains to reroute water away from your foundation. This can be very effective in preventing damage from flooded basements and garages, as the drains will keep a lot of that water from actually reaching your home. Depending on how the French drains are set up and where they drain to, this can move a significant amount of water away from your home during a storm.

Upgrading Your Defenses

If you’re considering home improvements, there are a few options you might consider. If thunderstorms are common where you live during the summer, installing a lightning rod or other lighting protection components can be a good idea. You also might want to get transient voltage surge suppressors to plug high-value electronics such as computers and televisions into as well, since these help to limit voltage to 1.5 times the normal voltage range. While this is still higher voltage than these devices are used to, they are much more likely to survive without damage compared to the significant amount of voltage they might experience during a lightning strike surge.

Other improvements you can make to better protect you during a storm include installing new windows and a new roof. Advances in window and roof materials make them much more durable than they were even a decade ago, and if your windows and roof have been in place for a long time, then they might already be experiencing some wear and tear. Not only will replacing them before the weather gets bad help to prevent leaks and other storm-related problems, but in the event of a big storm, you may even have an installation warranty on your side.

Review Your Policies

One last thing that you might want to do is look over your homeowner’s insurance and any other insurance policies you have for your property to see exactly what is and isn’t covered regarding storm damage. Flood damage commonly isn’t covered by standard policies, and depending on where you live there may be other storm-related exclusions as well. You definitely don’t want to wind up surprised at your coverage level if you have to make a storm-related claim.

If you’re looking for additional coverage or considering changing your existing policy, let HomeKeepr help. Our app can connect you with insurance agents in your area who will make sure you have the coverage you need for whatever problems might come your way. Creating a HomeKeepr account is free, so sign up today!

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

By: Homekeepr, Rob Morelli

Tags: Orlando Sellers

Posted in Home Tips from Teri, Orlando Buyers | No Comments »

June 7th, 2022 by tisner

Searching for the right mortgage for your new home is likely the most important step when buying a new home. Having that preapproval lets you know how much house you can afford as well as getting your wallet ready for budgeting. There are some things you can do that can make lenders second guess your application, and you want to avoid doing anything that can sabotage the purchase of a new house:

- Not knowing what is on your credit report can set you up for a surprise when a potential lender pulls it for inspection. Obtain a free report through your bank or credit union so you can correct or dispute errors before you fill out a loan application.

- Sending late payments on credit cards and other monthly bills during the approval process will show on your credit report.

- Opening a new line of credit for large purchases will raise your debt-to-income ratio (DTI). Except in emergencies, avoid buying anything on credit until after closing on your new home.

- In the same manner, closing credit accounts can negatively affect your credit score. If you have paid off credit card balances, leave them active, as this shows lenders that you have credit options available.

- Trying to help a family member get a loan by co-signing with them will raise your DTI and can discourage lenders.

- Unless it is completely unavoidable, changing jobs can hurt your loan chances. Lenders like to see a steady income from employment with the same company or same field.

- If you are using gifted funds to assist with the down payment, do not deposit the money into your bank account without documentation from the giver. Learn more about the procedures for down payment gifts from the balance.

- Do not let poor credit and lack of a 20% down payment keep you from buying a house. FHA, USDA, and the VA all have programs to help make the dream of homeownership a reality. Check each website for eligibility requirements.

Lastly, buying a home without a REALTORⓇ can be a costly mistake. No, there is no money coming directly from your pocket to pay the buyer agent–their pay comes from the home sale. Find a reputable agent who knows how to find the right house for your budget as well as your wants and needs, plus knows all about negotiating a home sale price.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Photo credit: CNBC

Posted in General Real Estate, Orlando Buyers | No Comments »

May 17th, 2022 by tisner

While meeting with a lender to discuss the purchase of a new home, you may hear and read words you are not familiar with. Knowing these financial terms and acronyms will make that meeting go more smoothly. Here are some common financial terms that will come up during your mortgage transaction:

- Adjustable-Rate Mortgage (ARM): a type of mortgage in which the interest rate applied to the outstanding balance varies throughout the life of the loan. A fixed rate may be applied for the initial loan period, but after that, the rate will fluctuate. Sometimes called a Variable Rate Mortgage.

- Annual Percentage Rate (APR): the yearly rate of interest that an individual must pay on a loan

- Closing Costs: fees and expenses paid at closing, beyond the down payment; costs can run 3 to 5 percent of the loan amount and may include title insurance, attorney fees, appraisals, taxes, and more

- Debt-to-Income Ratio: the borrower’s monthly debt payments divided by their gross monthly income; the number is one way lenders measure the borrower’s ability to manage monthly payments of the loan they receive

- Earnest money deposit (EMD): deposit made after buyers make an offer on a property; sometimes referred to as a good faith deposit; held in escrow until closing

- Escrow: an arrangement in which a third party distributes the money paid during the property-buying transaction

- Fixed-Rate Mortgage (FRM): a type of loan in which the interest rate on the mortgage is fixed; the rate will not change during the term of the mortgage

- Loan Estimate: tells important details about the mortgage loan requested; compare and choose the loan that’s right for your budget by getting a loan estimate from more than one lender

- Pre-Approved: when the home buyer is approved by a lender for a specific loan amount after the buyer provides documented financial information to be reviewed and verified by the lender

- Pre-Qualified: an estimate of how much the home buyer can borrow based on a review of financial information; not a guarantee of being approved

Do not go into the lending process without some knowledge under your hat! Going into what is probably your largest investment without knowing anything about it may end up in disappointment and having to wait longer to buy your new home. The Consumer Financial Protection Bureau offers many other terms not listed here and is a great resource for learning more.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Photo credit: bettermoneyhabits.bankofamerica.com

Posted in General Real Estate, Orlando Buyers | No Comments »

April 29th, 2022 by tisner

Finding the right loan to meet your needs can be one of the hardest parts of buying a new home. There are a number of mortgage options out there, and if you choose one that isn’t really ideal for your situation, then you might end up paying a lot more for it in the long run. With so many options, though, how do you know that you’re getting the best loan to match your situation?

It might take a little bit of homework, but there are actually a few different ways to sort through potential loans to find the best one for you. A lot of things can affect the loans that are available to you, including where you live, what your credit history looks like, and even the state of the economy. With that said, here are a few things that you should keep in mind when shopping around for loans to help ensure that you get the loan that best meets your needs.

Interest Considerations

Getting a good interest rate on a mortgage loan is obviously a big concern for most potential buyers, since even a small difference in interest rates can result in large savings when choosing between two mortgages. This is one of the big reasons that it’s recommended that you shop around for your mortgage, comparing quotes from a few different lenders to find the one that offers you the best interest rate. The rate alone isn’t the only thing that you need to consider when comparing loans, though.

Interest can take multiple forms on mortgage loans. Fixed-rate loans lock in a single rate for the entire repayment period, while variable-rate loans can change over time (usually once per year and with the amount of change capped, but the exact details can differ between loan providers). Some mortgages even act as a hybrid between these two, locking in a low rate for a specific period and then changing it after that period has ended. Understanding the type of interest that a mortgage features and how it will work over the course of the loan can help you avoid unexpected payment changes down the line.

Loan Terms and Features

The term of your mortgage is another thing that you should pay careful attention to, since it can affect both your monthly payment and the amount that you pay in interest over time. Longer-term loans may cost you more in the long run, especially if you have a loan that will increase in interest over time. Likewise, shorter-term mortgages can save you money in interest, but might be harder to pay each month due to a higher overall payment. You should also watch out for loans that only have you pay against interest during the first part of the loan’s term; this starts you off with a low monthly payment, but isn’t reducing the amount that you owe at all until the payment increases.

There are other mortgage considerations that you should keep in mind as well. Most mortgages will require you to cover a portion of the property being purchased in a down payment, and the down payment amount can vary significantly between lenders. Different loan programs such as loans secured by the FHA can reduce this and some other costs as well. Just be sure to do your due diligence in exploring your loan options first.

Finding the Perfect Loan

The key to finding the mortgage that’s right for you is finding lenders that you can trust. Fortunately, HomeKeepr can help you with this. Our app can connect you with lenders and loan professionals so that you can compare offerings and secure the best mortgage that you can find. Creating an account is free, so sign up today and get started in your hunt for the perfect mortgage loan. Your dream of becoming a homeowner is just a few steps away!

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

By: Homekeepr, Rob Morelli

Posted in General Real Estate, Orlando Buyers | No Comments »

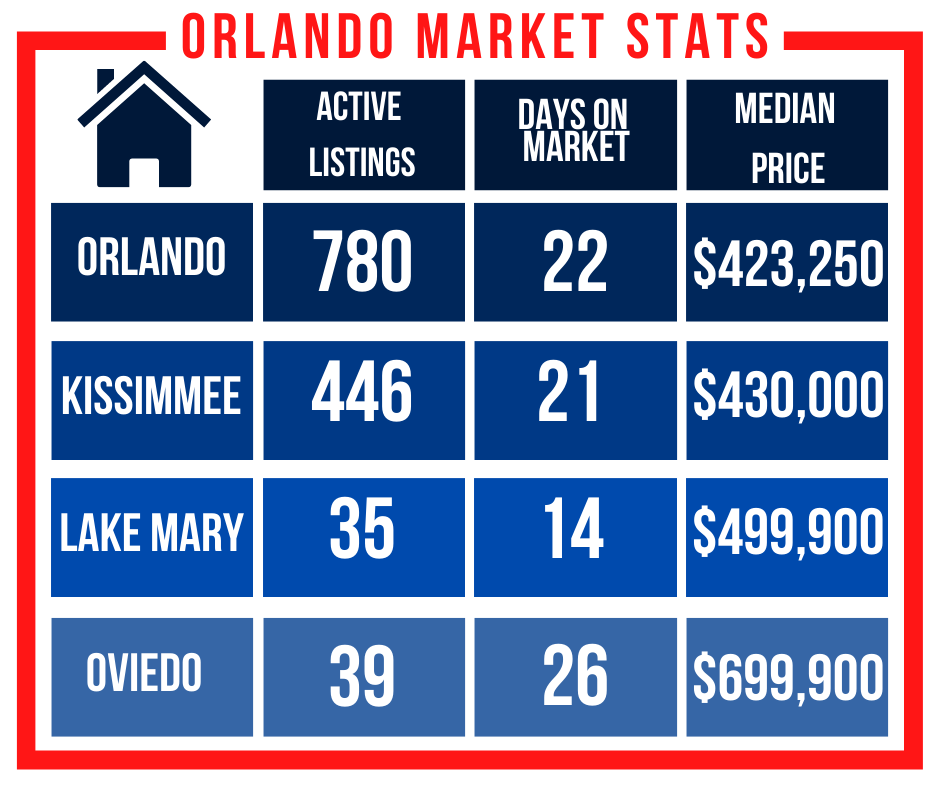

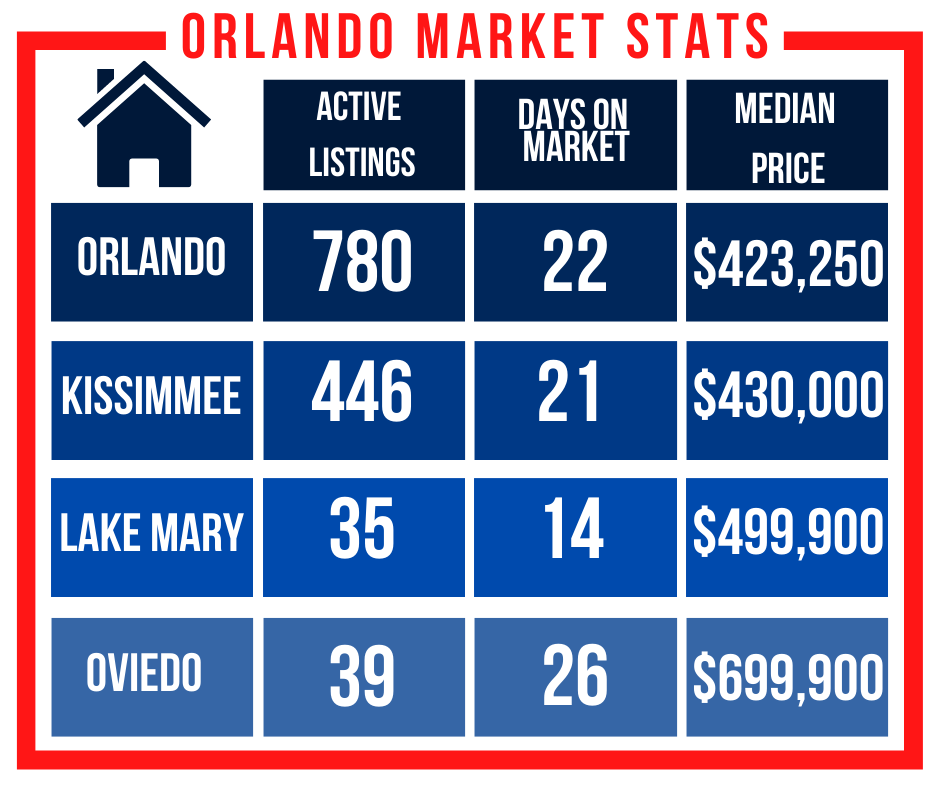

April 28th, 2022 by tisner

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Stats courtesy of StellarMLS

Tags: housing market updates, Orlando Sellers

Posted in About Orlando, Housing Market Stats, Kissimmee, Orlando Buyers | No Comments »

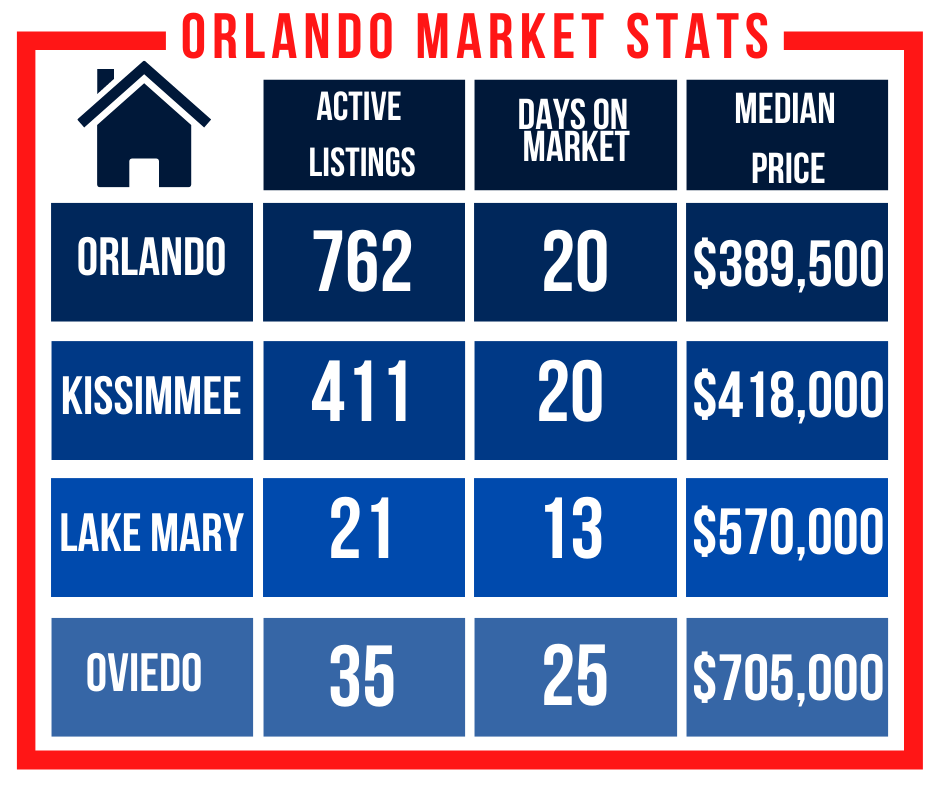

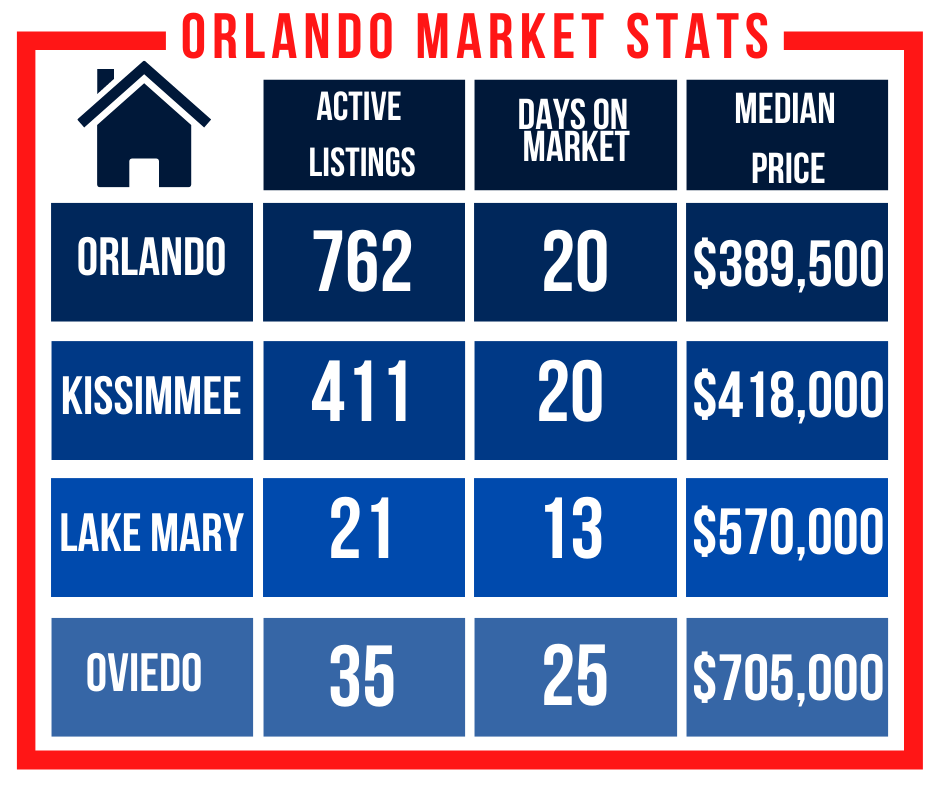

April 14th, 2022 by tisner

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Stats courtesy of StellarMLS

Tags: housing market updates, Orlando Sellers

Posted in General Real Estate, Housing Market Stats, Orlando Buyers | No Comments »

April 7th, 2022 by tisner

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Stats courtesy of StellarMLS

Tags: housing market updates, Orlando Sellers

Posted in Housing Market Stats, Kissimmee, Orlando, Orlando Buyers | No Comments »