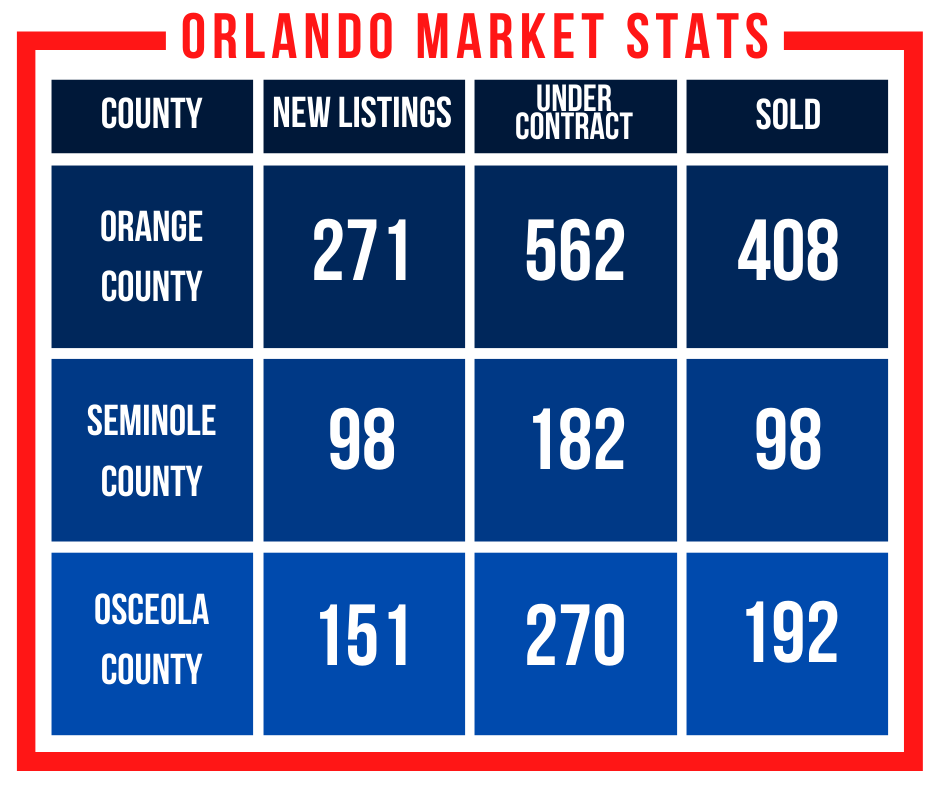

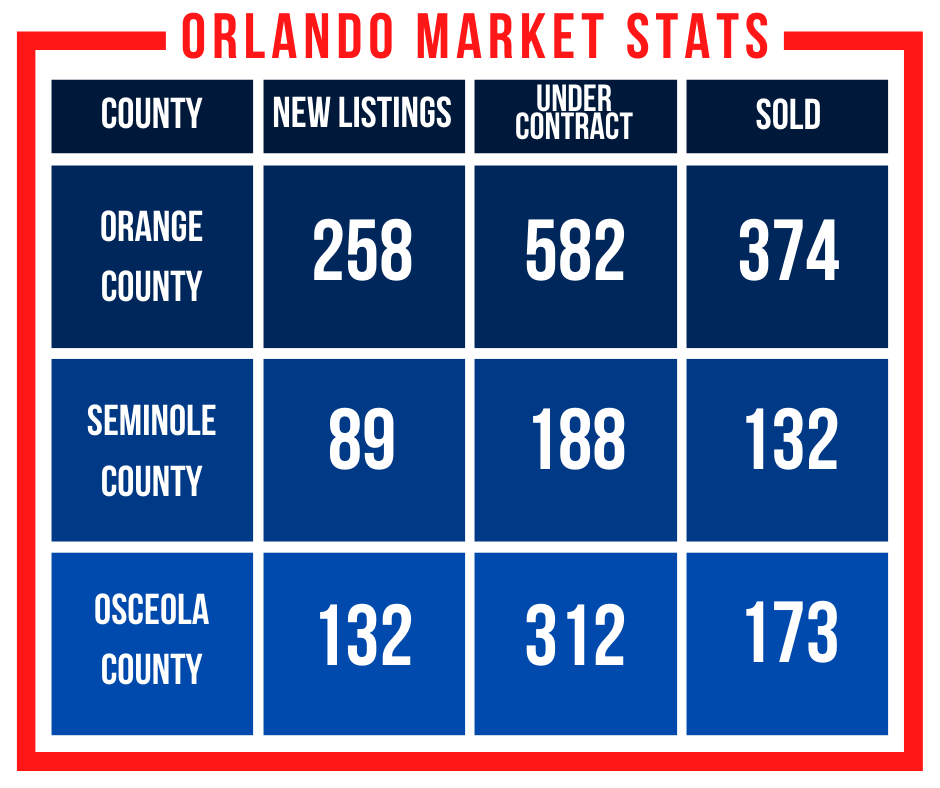

March 25th, 2021 by tisner

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Stats courtesy of StellarMLS

Tags: housing market updates, Orlando Sellers

Posted in General Real Estate, Housing Market Stats, Orlando Buyers | No Comments »

March 16th, 2021 by tisner

Choosing to purchase a home warranty is something any homeowner, house hunter, and even seller should think about. While different companies offer home warranties, the purpose of a home warranty is generally the same. Let this guide help you decide if you need this service:

- A home warranty covers what homeowner’s insurance does not. When one of your home’s systems or major appliances breaks down or is damaged from normal wear and tear, a home warranty will help you with the costs.

- Homeowners pay a monthly fee, on average $300-$600 per year, according to Consumer Affairs. Most service calls through the company will require the homeowner to pay a set service fee to the technician when making a claim.

- A home warranty can be purchased at any time, which is great for someone who is selling their home. Sellers can spend a good amount of money prepping the house for sale, and a warranty will help considerably if something breaks down during the selling process. Warranties can be transferred to the buyer, as well!

- A newer home may not necessarily need a home warranty, so stash an amount equal to a monthly warranty payment into your savings account! You can build emergency savings and have the funds for unexpected repairs.

- Research home warranties for prices and coverage available. Your Realtor® will be able to direct you to companies they are familiar with, and you can trust you are working with a reputable home warranty company.

- Current homeowners who do not have a home warranty can find a company that is registered with the Service Contract Industry Council. Scroll to the “Home Service Contract Companies” for a complete contact list.

There are so many different decisions to make when it comes to homeownership, it can feel overwhelming. Making good decisions depends on how much time you put into researching and asking questions. Inform yourself by doing your research and having a discussion with your Realtor® and/or warranty agent to help make the best home warranty decision for your home and wallet.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Photo credit: American Home Shield

Posted in Home Tips from Teri, Orlando Buyers | No Comments »

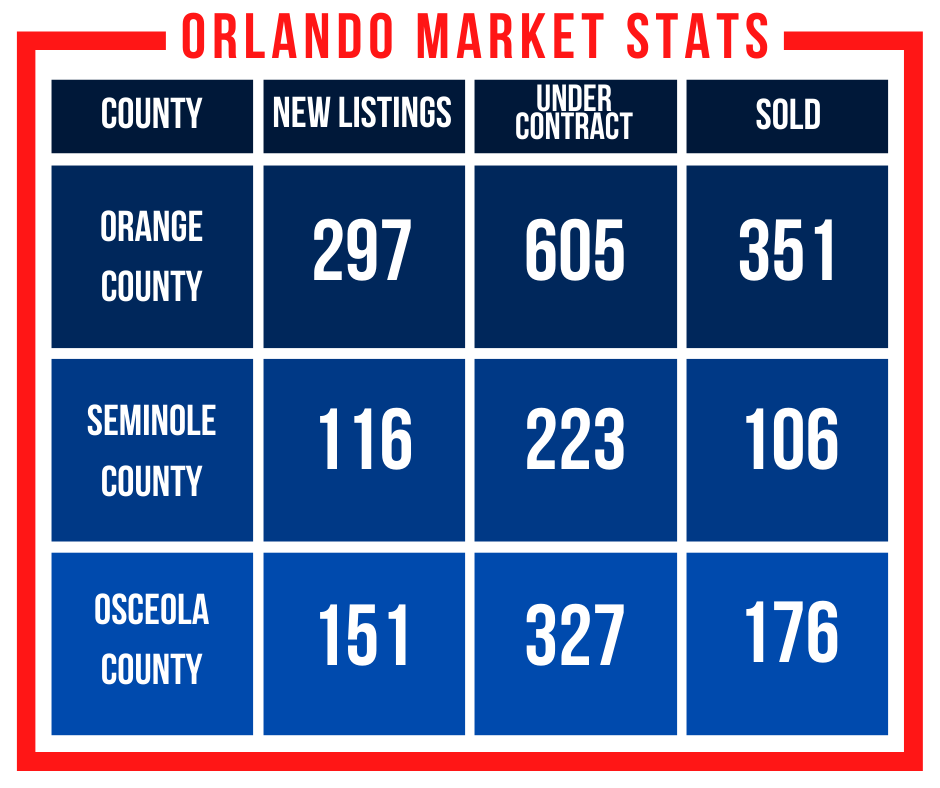

March 11th, 2021 by tisner

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Tags: housing market updates, Orlando Sellers

Posted in General Real Estate, Housing Market Stats, Orlando Buyers | No Comments »

March 9th, 2021 by tisner

As closing day approaches, it is so exciting to think about the move to your new home! There is one thing that is keeping you in check, however, and that is the final walkthrough. This is the last step in the home-purchase process and should not be skipped. What takes place in the final walkthrough, and what part does the homebuyer play?

Here is your guide to this essential step:

- Your agent will schedule a time meet at your new house, usually after the seller has moved out and before or on closing day.

- What should you have on hand with you?

- the final contract with all the specifics about the sale

- home inspection report

- any written agreements between seller and buyer

- a notepad and pen

- a camera or use your smartphone camera

- a nightlight to test electrical outlets

- Inside the house, everything should be in perfect working order:

- Turn on every light switch and check every outlet.

- Check the faucets in the kitchen, bathrooms, outdoor spigots, utility room, and any other room there is running water by turning on each one. Flush all toilets as well. All toilets should flush completely, and drains should flow freely.

- Inspect every area where agreed repairs should have been made. If there have been extensive fixes made, you may want to shell a bit extra out of your wallet to have someone with you that can be certain the job was done correctly.

- Inspect every appliance that is included in the sale to be sure it is running properly.

- Open and close all doors, windows, cabinets, and drawers.

- Pay careful attention to carpets and floorcoverings, every floor and wall for weakness, cracks, mold, mildew and do not forget to look for signs of pests.

- Turn the climate control off and on, and check heat as well as air conditioning.

- roof, gutters, shutters, or any other structural issues

- garage doors functioning properly

- debris or trash left by the seller

- lawns and landscaping should at least be trim and neat

Hopefully, your final walkthrough will go perfectly, and closing can proceed. If you run into any adverse issues, however, note them, and have your agent contact the seller. Final walkthrough problems are just another reason to have a Realtor® represent you as a buyer, as they can handle the not-so-smooth issues that come with buying a home.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Photo credit: Homie.com

Posted in General Real Estate, Home Tips from Teri, Orlando Buyers | No Comments »

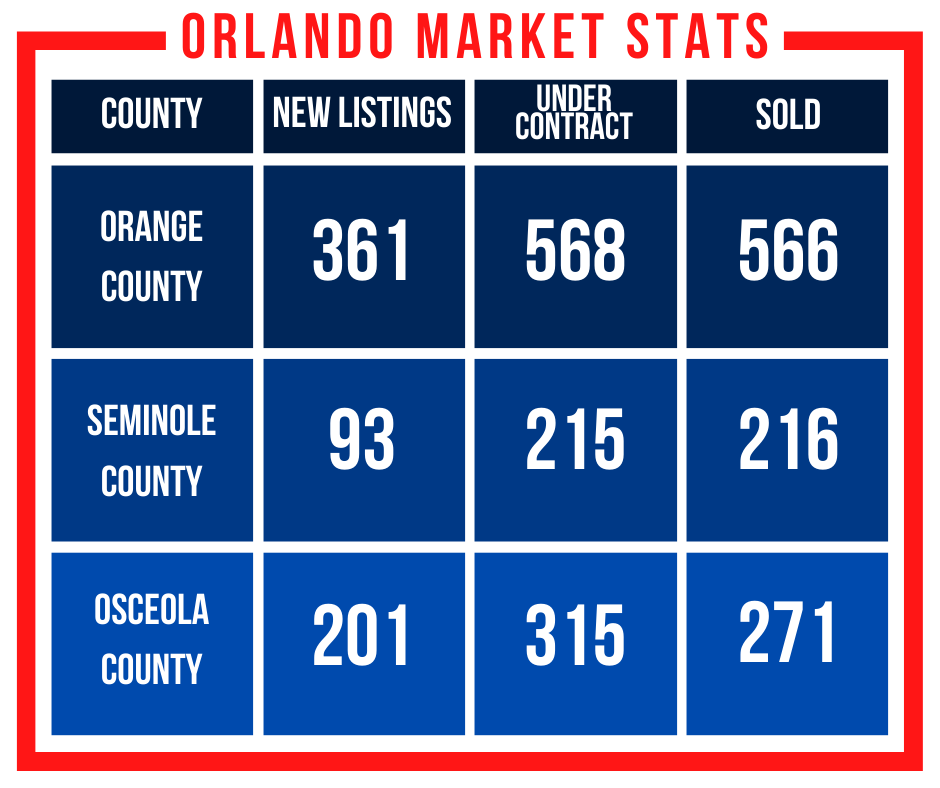

March 4th, 2021 by tisner

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

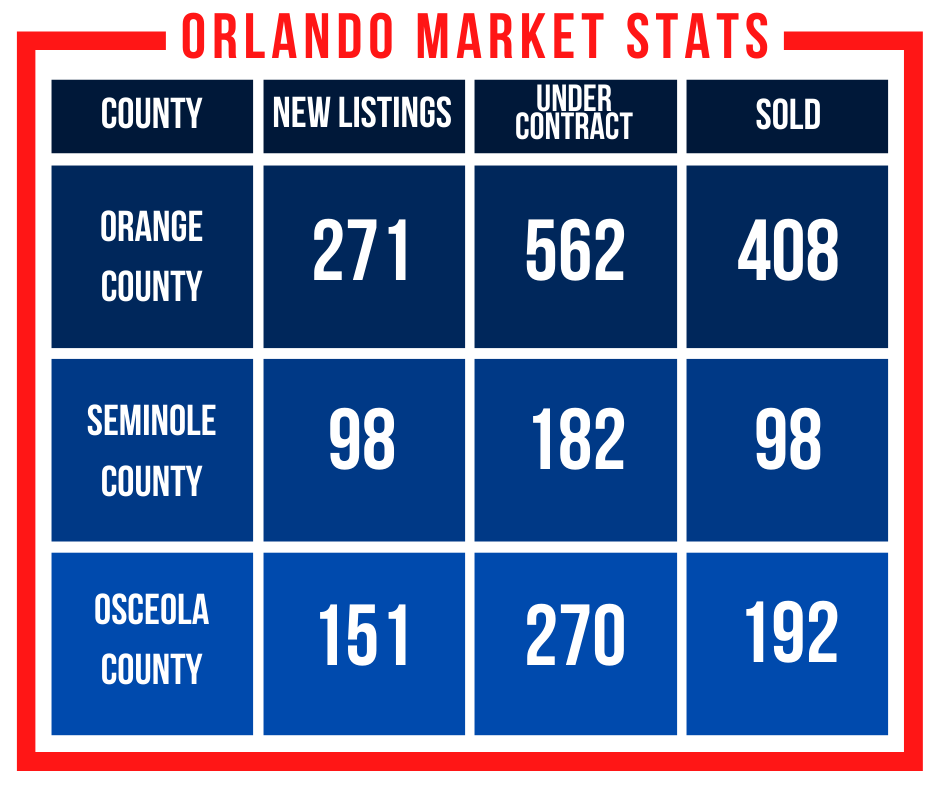

Stats courtesy of StellarMLS

Tags: housing market updates, Orlando Sellers

Posted in General Real Estate, Homes, Housing Market Stats, Orlando Buyers | No Comments »

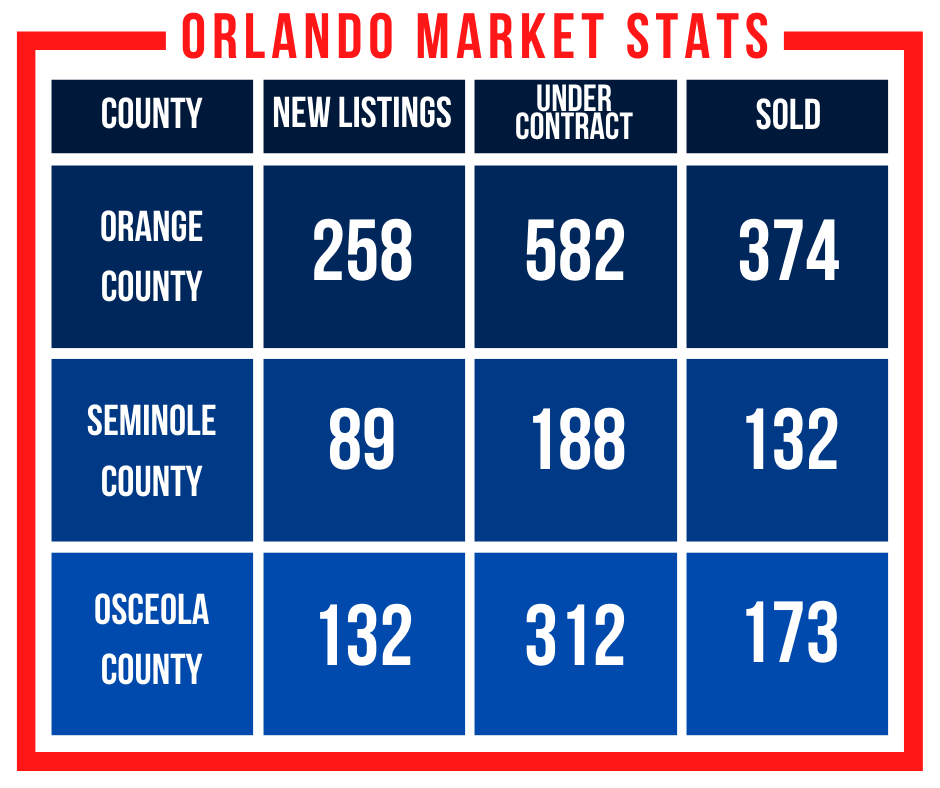

February 25th, 2021 by tisner

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

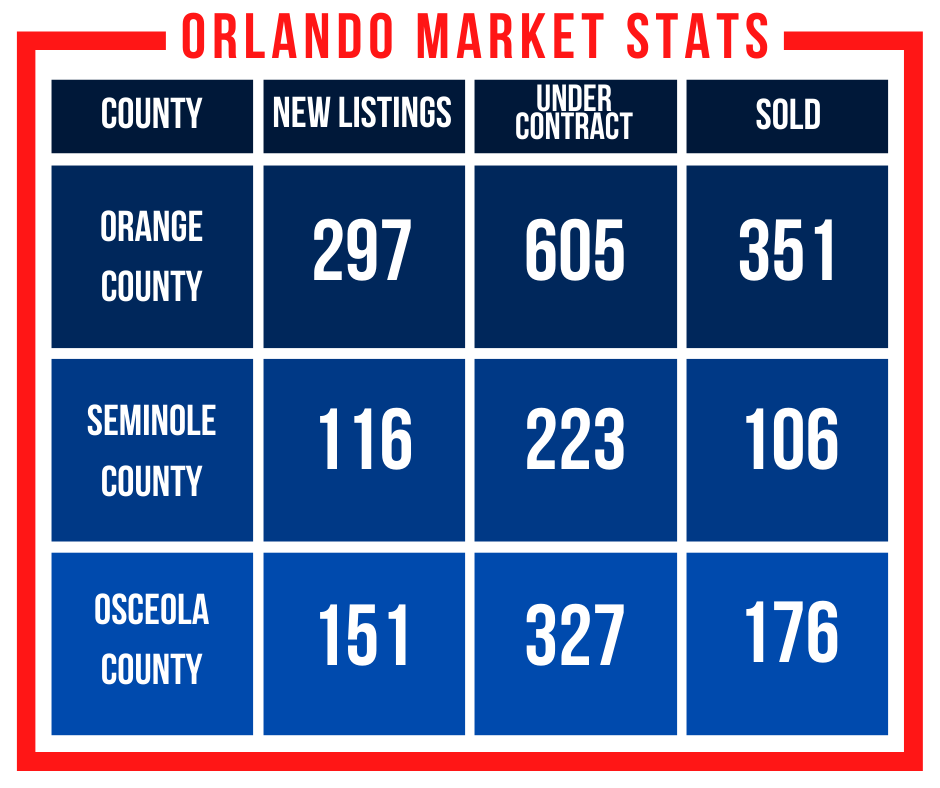

Stats courtesy of StellarMLS

Tags: housing market updates, Orlando Sellers

Posted in Housing Market Stats, Orlando Buyers, Osceola | No Comments »

February 23rd, 2021 by tisner

When your children are grown-and-flown, or your retirement is on the horizon, it is time for some decisions to be made. Do you still need all the space you currently own? Do you dream of selling your home and traveling the world? No matter what your reasons are for downsizing, let these tips help smooth the process:

- Jot down your ideas, and talk with family and/or friends, share your thoughts, and have some of them help you start a Downsize Plan.

- Think practically before you finalize your decision:

- Do you want to stay in the general area you are currently in or do you want to move across the country? Compare your home’s value to the locations you are interested in, making certain it is financially wise to relocate there. Even a move across town to another neighborhood could cost more in the long run.

- Maybe you have dreamed of traveling, and RV-living is more to your liking. If you think this is what you want, it may be a good idea to rent a travel vehicle for a long trip before you make a costly purchase, just to get an idea of RV life.

- Are you tired of maintaining the yard and exterior of your home? Maybe a condo or townhome is right for you.

- If you decide to sell and move to a smaller home, the first step of the moving process is going through your belongings. Sixty&Me.com has some extreme but practical advice to help you start this emotional task.

- Do your children still have belongings stored in your attic or spare room? Have them pick a date to come over and go through them. They need to be aware that this is their last chance to have their things donated, thrown away, or keep them. Otherwise, you will be making those decisions.

- With a lifetime of “stuff,” it may simply be impossible to begin the first step on your own, and this is where a pro may help. Professional organizers do not only clean up closets, there are those who specialize in home clean-outs and downsizing.

- A smaller house means less space for your furniture. Find out if any family members want the pieces you will not take with you or get ready to sell or donate your pieces. Some thrift stores will refurbish the items, and domestic violence or homeless shelters can always use practical pieces in good condition.

- Once you finalize your decision, get in touch with a real estate agent. They will not only help you sell your home for the best price, but they can also assist with finding your new home!

If you are getting ready for retirement or dreading the thought of the last child leaving home, downsizing can be something to look forward to–a new beginning! Whether you decide to travel the world or settle in a houseboat, your Realtor® will help you through selling your nest, every step of the way.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Tags: Orlando Sellers

Posted in Home Tips from Teri, Orlando Buyers | No Comments »

February 17th, 2021 by tisner

There’s a lot to learn when you’re starting out on your home buying journey. From concepts like earnest money to closing costs, it’s a lot to take in during a very short period. But of all the things to know, understanding the difference between being pre-qualified and pre-approved for your mortgage is one of the most important.

Why Your Mortgage Application Status Matters

It’s always been a good idea to bring a strong offer to the negotiating table when it comes to real estate, but it’s even more vital when the market is short on inventory and long on buyers. If you’re in a multiple offer situation (and sometimes, even if you’re not), the sellers are going to weigh the various offers they receive to decide if they think your offer is enough to bring in what they need to sell their home, as well as considering how strong an offer it is.

A strong offer is one that has a lot of the obstacles already removed. For example, if you need to sell your house before you can close on the one you’re making an offer on, this might be considered a weak offer for some sellers. A weak offer doesn’t mean a bad offer, necessarily; it’s simply an offer that looks like it could be tricky to actually get to the closing table. The risk versus reward is too high. This is why having the right kind of mortgage application status plays in your favor when it comes to negotiation.

Mortgage Pre-Qualification Versus Mortgage Pre-Approval

When you meet with a lender for the first time, they generally ask some probing questions about your income and assets, as well as your expenses and credit file. They’re not just being nosy; that lender is trying to help figure out just how much home you can qualify for and what programs might be best for your financial picture. Sometimes, these lenders will send you elsewhere because their banks or partner lending institutions simply can’t help you, but in a lot of cases they’ll produce something called a pre-qualification letter.

Pre-qualification goes largely by your word about your income and expenses, and is not a promise to lend. It’s simply a hypothetical among a list of hypotheticals. If you do in fact make this much money, your credit is as assumed, the house you choose lines up with these guidelines, and rates don’t change dramatically, you should be able to buy this much house. You can see how that would be a bit dodgy for a seller to hang all their hopes on.

A pre-approval, on the other hand, shows that you’ve gone through the additional steps to reach the highest level of mortgage approval you can get without actually having a house secured (the house you choose also figures into the final approval, but just how it figures depends on the loan program). For a pre-approval, you’ll need to provide income documents, permission for the lender to pull a full credit report, and details on any assets or liabilities you hold that aren’t included in your credit file.

A pre-approval isn’t instant; it requires more review, and you’ll need to choose a lending program to be approved for. However, doing all this extra work shows potential sellers that you’re already putting in a lot of effort to ensure you can actually close when the day comes, and that you’re eager to move the process along as quickly as possible. That’s the kind of buyer a seller wants to see!

Getting Pre-Approved for a Mortgage

It doesn’t have to be tough, especially when you look in your HomeKeepr community for recommendations for the very best lenders in your area. These mortgage professionals can ease the paperwork burden and help streamline your pre-approval so you’re more than ready to make an offer on a home that you’ll love for years to come.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

By: Homekeepr, David Weinstein

Posted in General Real Estate, Home Tips from Teri, Orlando Buyers | No Comments »

February 16th, 2021 by tisner

Buying a house is a huge commitment and saying it must be “right” is an understatement! Whether you are looking for a new beginning, have a growing family, or are simply buying your first home on your own, buying a house that is not the best choice can have you looking for another or even losing money. How do you know you have found the one? Here are a few tips to help you with your house-hunting:

- The listing photos and layout have you wanting to see it in person as soon as possible! When the photos appeal to you in some way and the layout is to your liking, it is hard not to send your agent a “Put this house at the top of my must-see list” text!

- At the showing, you feel at home when you get out of your car and walk in the door. You know when you feel welcome in a house when you go inside, much like when you visit someone’s home for the first time.

- As you go from room to room, you can see your belongings in each, and know exactly how you would arrange them. The outside matters as well, and envisioning your kids playing in the back garden, or wanting to refurbish the flowerbeds are sure signs of the house being the right one.

- Your house-hunting day has ended, and that one property seems to be calling your name, but minor things (like having to remove wallpaper or carpet) have you questioning if that is the house for you. When you are truly smitten, being concerned about a few flaws and having to put in some work once you move in could cost you the perfect home.

- When the showing is over, and you pause on the outside of the door and have no desire to look at any other houses, it is time to talk to your agent about making an offer.

- Does the house fit your needs? All the warm fuzzies do not count unless the house has the right amount of space, is in a great community, and, most importantly, within your budget.

House hunting can be tiring, especially if you have looked at several in one day. If all the factors are in line, you may not want to wait to act on making an offer! Waiting to see if you can find a more perfect house may cause you to lose out on the house that embraced you as you walked in and had you telling friends and family about. Your Realtor® knows about your needs, wants, and budget, and will be ready as soon as you say “I love this house. Let us make an offer!”

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Posted in Home Tips from Teri, Orlando Buyers | No Comments »

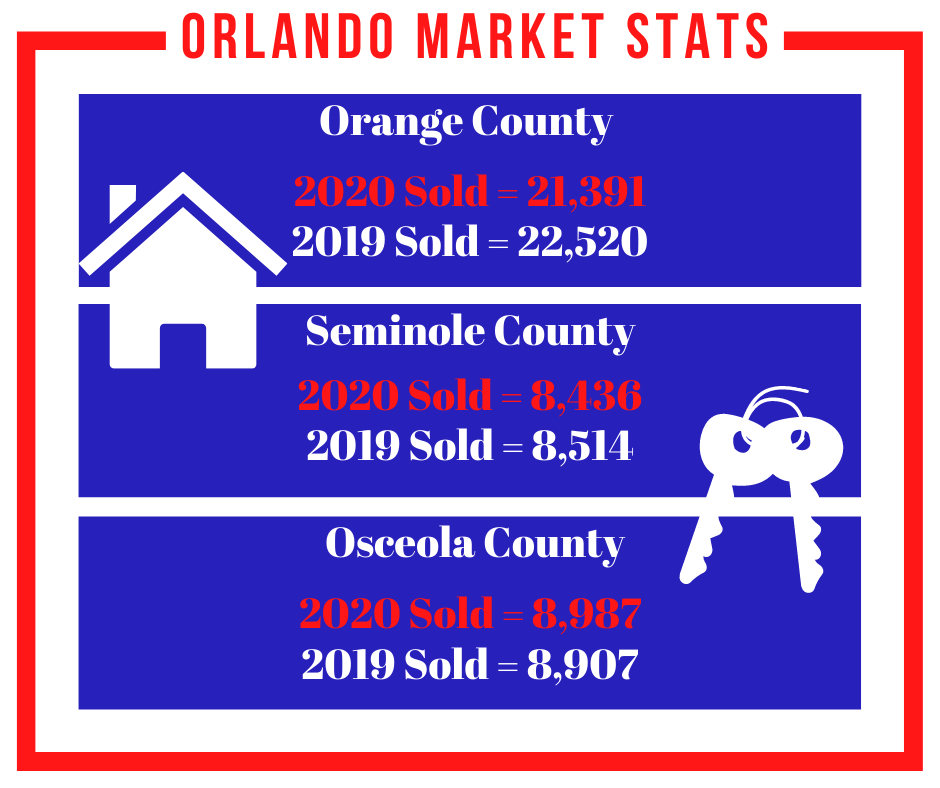

January 7th, 2021 by tisner

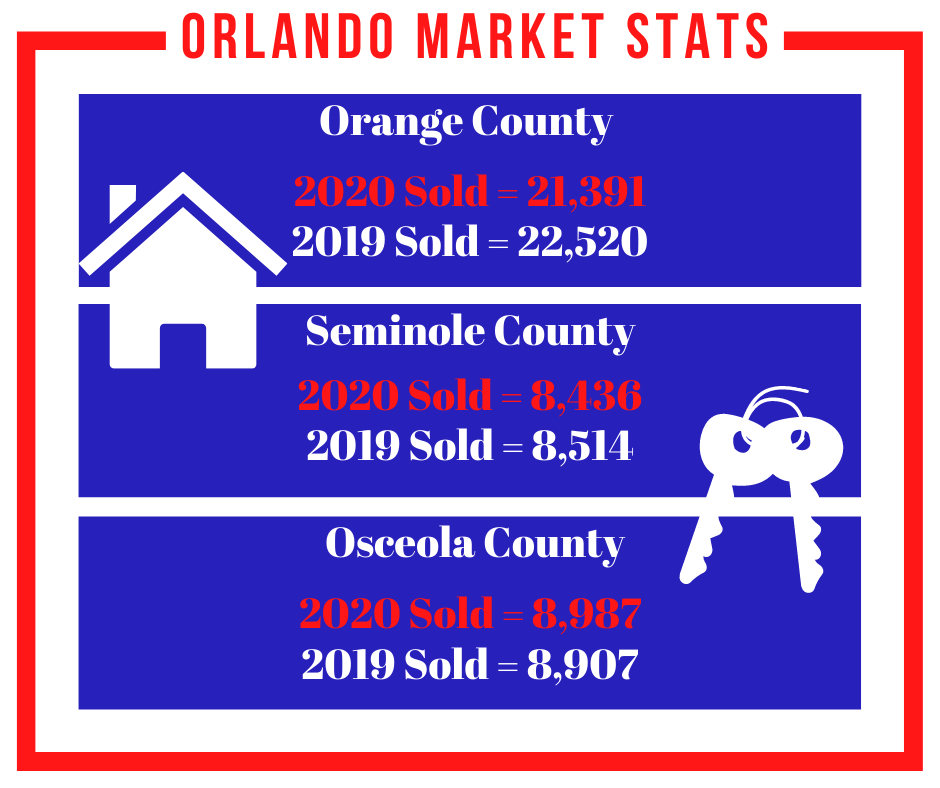

Here are the final SOLD sales numbers compared to 2019 for condos and single-family homes.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Stats courtesy of StellarMLS

Tags: 2020 Final Sales Numbers, home sales, housing market update, orlando avenue top team, Orlando Sellers, Teri Isner

Posted in Orlando Buyers | No Comments »