Orlando State of the Market October 2022

November 17th, 2022 by tisnerOrlando Area Residential Real Estate Snapshot for October-2022

State of the Market

- October’s interest rate was recorded at 7%, a 10% increase from September when the interest rate was 6.3%. The last time interest rates were this high was May 2002.

- That 7% interest rate in October 2022 was 131% higher compared to October 2021 when the interest rate was recorded at just 3%.

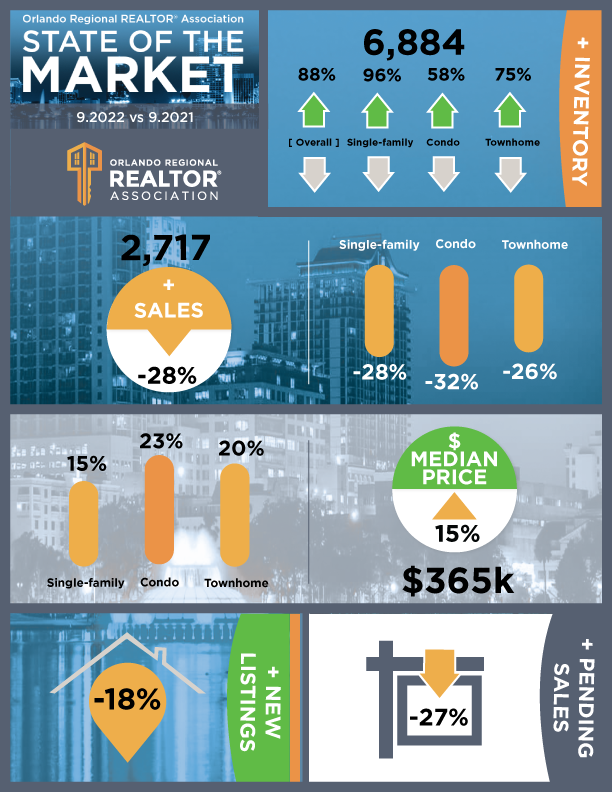

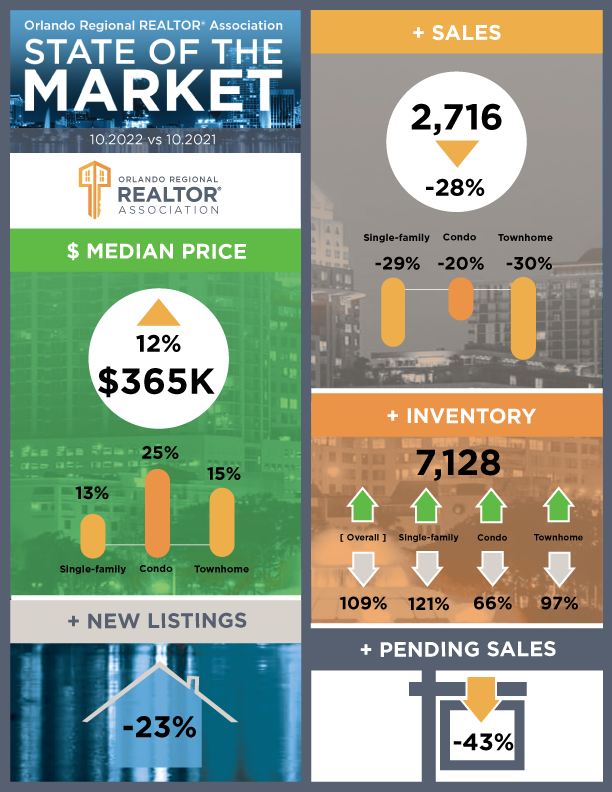

- Inventory rose 3.5% from September to October, from 6,884 to 7,128. This is the eighth straight month of inventory increases.

- Inventory in October 2022 was 109.3% higher compared to October 2021, when it was recorded at 3,406 homes.

- Homes spent an average of 38 days on the market in October, up from 31 days in September.

- New listings decreased by 8.3% from September to October, with 3,041 new homes on the market in October.

- Overall sales in October held steady from September. There were 2,716 sales in October – down one sale from September.

- The median home price for October was recorded at $365,000, the same median home price recorded in September. This comes after three consecutive months of decreasing median home prices.

- “We have the perfect storm of economic uncertainty in the U.S. accompanied by the highest interest rates Orlando has seen in more than 20 years,” said Tansey Soderstrom, Orlando Regional REALTOR® Association President. “Rapidly rising interest rates are having a huge impact on buying power. Home Prices and sales are flat from September to October, but rising rates are causing buyers to look at different price points in order to find a monthly mortgage payment that they are comfortable with.”

Market Snapshot

- Interest rates increased as the average interest rate for October was recorded at 7%. This is 131% higher than October 2021 when interest rates were 3%.

- Pending sales decreased by 24% from September to October for a total of 2,915 pending sales.

- 20 distressed homes (bank-owned properties and short sales) accounted for 0.7% of all home sales in October. That represents a 66.7% increase from September, when 12 distressed homes sold.

Inventory

- Orlando area inventory increased by 3.5% from September to October from 6,884 homes to 7,128 homes. Inventory in October 2022 was 109.3% higher than in October 2021, when it was recorded at 3,406 homes.

- The supply of homes increased to 2.62 months in October. This is the third month since June 2020 with over two months of supply. A balanced market is six months of supply.

- The number of new listings decreased from September to October by 8.3% down to 3,041 homes.

ORRA’s full State of the Market Report for September can be found here.

Access Teri’s one-stop Orlando FL home search website.Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

By: www.orlandorealtors.org