FORT LAUDERDALE, Fla. – As the housing market has cooled considerably, sellers are now wrestling with whether to sell their homes as soon as possible or hold off on selling.

Two years ago, it was an easier decision: Prices were at record highs, interest rates were lower than they had been in years, and buyers were so desperate to get into a home that they often bid up on homes and waived any appraisals.

But now, with more homes coming to the market and higher interest rates, buyers have started to reclaim more of the power, throwing sellers into unfamiliar territory.

With the market having shifted, is it more beneficial for them to sell now or wait for another boom?

“We ask them a simple question: ‘Do you think your house will be worth more in six months or a year than it is today, looking at the way the economy is and what interest rates are?’” said Alex Platt, a Realtor with the Platt Group at Compass in Boca Raton.

A seller’s perspective

For Dr. Imran Mirza, the decision to put his home up for sale was an easy one. He saw the bidding wars around him and properties flying off the market, and decided to capitalize on South Florida’s record boom before a possible correction took place.

He finally closed on his five-bedroom, five-and-a-half bathroom house in Boynton Beach about a week ago for $1.4 million, a down adjustment from the price he wanted – $1.895 million.

It was still a significant profit from the $900,000 he paid for the home in 2017. There are “these kind of profits where people live in their homes for 20 years, and they don’t see these kind of profits,” he noted.

For potential sellers looking to list now, there is some anxiety around deciding to sell: Have they missed the peak of the market in terms of prices? Will holding off on selling decrease their ability to get a high price even more?

“If they are moving out of town, or if it’s a second home or investment home that they want to pull money out of in the next five years, they should really sell now,” said Brian Pearl, principal agent with the Pearl Antonacci Group in Boca Raton, said. “We are really trying to paint the picture, are you OK waiting for another 5 to 10 years? If you are not, you should strongly consider selling now. If you need to move, sell now because the future is uncertain.”

For Mirza, he believes that if the time is right in a seller’s life and if someone wants to sell, they should do it now rather than wait out the shifting market.

“I figured we were at the peak for selling it and you don’t want to wait another seven years for this to happen again,” he said. “If they put their house out now, they have a good chance of selling it.”

What sellers need to weigh

Most experts agree: If a seller needs to move and wants to, then they should put the home up for sale. However, if a seller likes their home and is comfortable with their current payments, then they should stay in their house.

“While things have cooled off in South Florida, this is still a good time to sell,” said Jeff Tucker, senior economist with Zillow. “I don’t see a whole lot to gain from waiting, in part because the market is turning and the higher interest rates are having a snowball effect and cooling the market even more.”

Stephan Gehrig, 38, sold his home in Delray Beach in August for about $2.2 million, a little before prices started to adjust in South Florida.

“I saw how I was kinda at the end of the peak,” Gehrig said. “I was one of the last homes that sold in the neighborhood. I waited to list and I saw how previous homes, they had all sold within a week or two, and I got concerned [when] mine didn’t.”

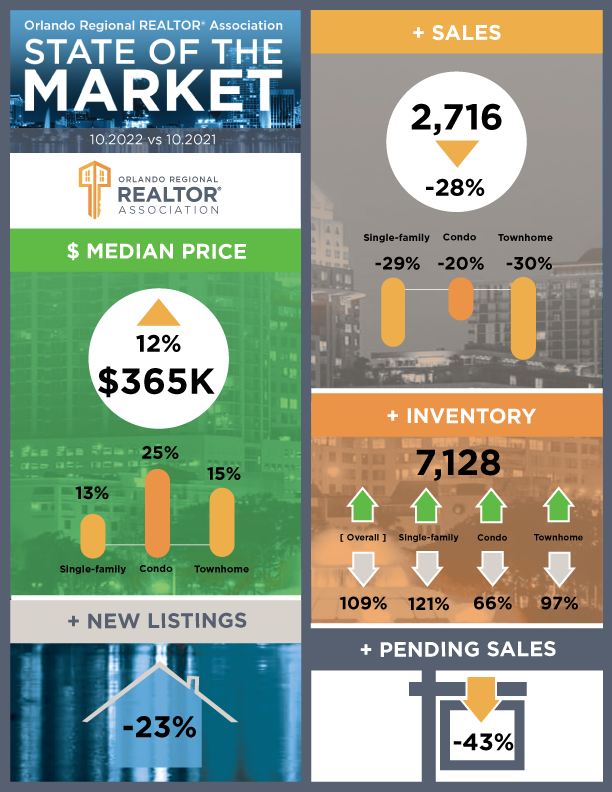

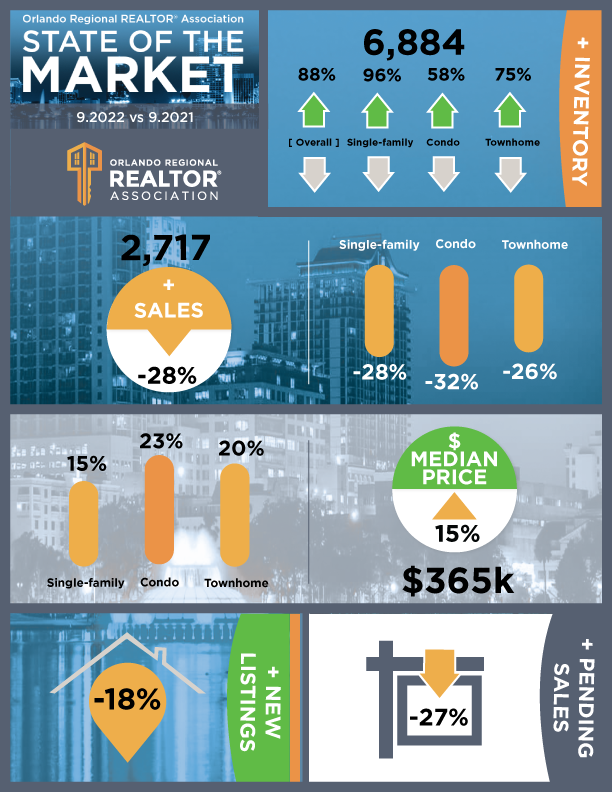

Interest rates and inventory levels have been the main driving force of the housing market. Right now inventory levels, while they have risen compared to last year, are still low enough to keep prices high, a plus for sellers. Should more homes become available on the market, sellers would face more competition in selling their homes, Platt noted.

“It does appear that prices will come down a lot more because people are cutting their asking price,” said Eli Beracha, director of the Hollo School of Real Estate at Florida International University.

For Gehrig, his home sold in less than 30 days, and while he had to compromise on price a little bit as he witnessed the beginning signs of the incoming cooldown, Gehrig still feels that the price was enough to make it worth listing his home.

“I do wish I listed sooner,” Gehrig said.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

© 2022 South Florida Sun-Sentinel. Distributed by Tribune Content Agency, LLC.