January 20th, 2016 by tisner

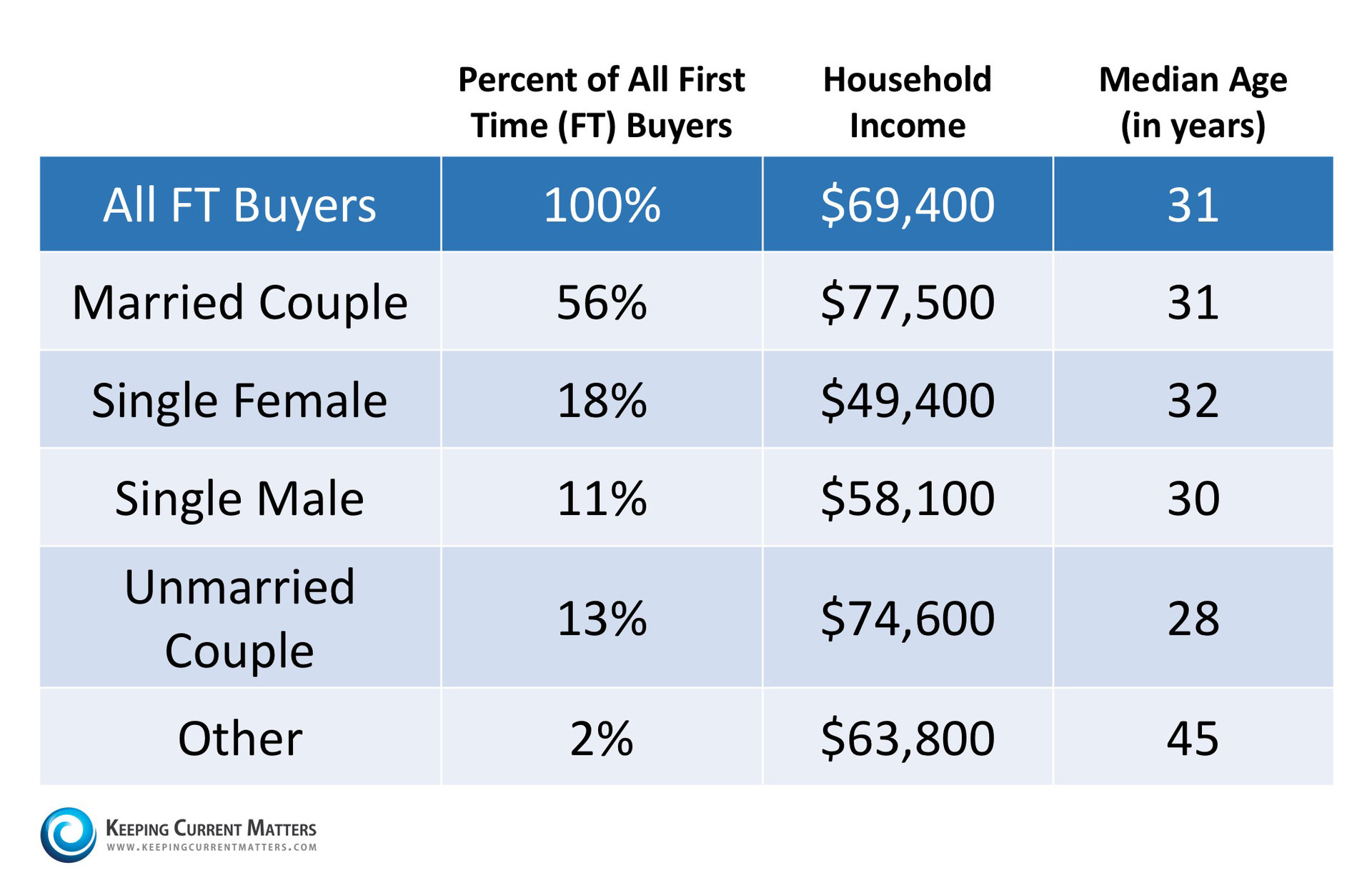

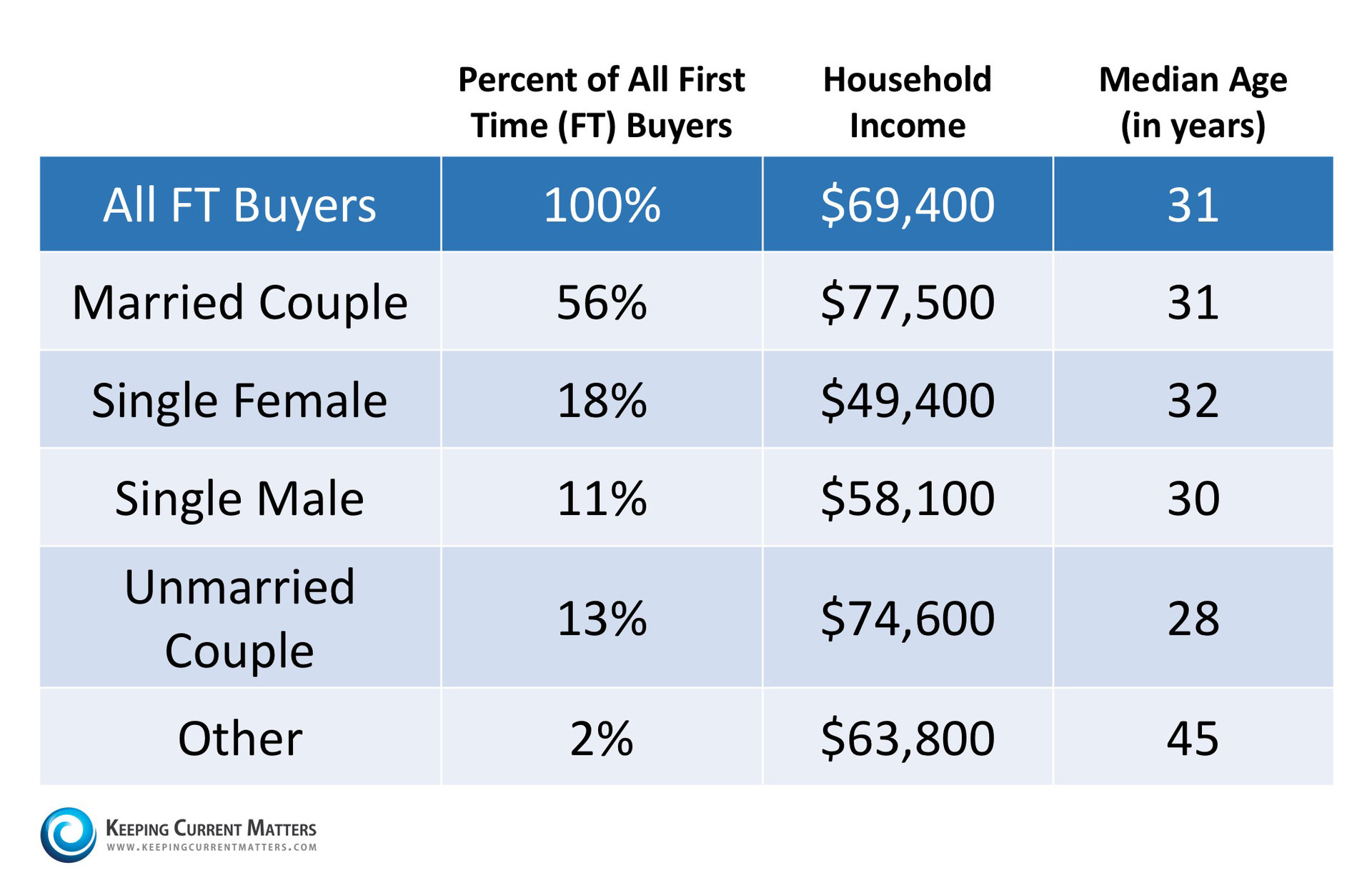

There are many people sitting on the sidelines trying to decide if they should purchase a home or sign a rental lease. Some might wonder if it makes sense to purchase a house before they are married and have a family. Others may think they are too young. And still others might think their current income would never enable them to qualify for a mortgage. We want to share what the typical first time homebuyer actually looks like based on the National Association of REALTORS most recent Profile of Home Buyers & Sellers. Here are some interesting revelations on the first time buyer:

Bottom Line

You may not be much different than many people who have already purchased their first home. Meet with a local real estate professional today who can help determine if your dream home is within your grasp.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Tags: first home, home buying tips, homebuyer, orlando aveneu top team, orlando real estate, Teri Isner

Posted in General Real Estate, Orlando Buyers | No Comments »

January 8th, 2016 by tisner

Home inspectors are good at their jobs but they are not above missing some things because they are human. There are several things that home inspectors have been known to miss during a home inspection so you might want to keep your eyes open and pay close attention during the inspection so that you don’t end up having to pay for expensive repairs once you move in to your new home. A few things that may be missed by your home inspector are below.

- Inspectors do not always go over all the bells and whistles of a home and appliances are on the list of things they do not always pay a lot of attention to. The last thing you want is to move into your new home to find out that you have a leaky dishwasher that needs to be replaced. If you want to make sure appliances have not been overlooked you may want to check them yourself.

- Leaky faucets are also things that can be overlooked by home Take your time to walk through your soon to be new home and check the faucets for leaks just in case your inspector may have missed something. It’s a good idea to check outdoor faucets as well.

- Cracked sewage and drainage pipes might also be something that your inspector doesn’t take a look at and may therefore miss. It may be worth your while to pay a bit of extra money to have an in depth look at your drainage pipes.

- Sometimes home inspectors will not pay a lot of attention to decks, porches and balconies. There can be problems in these areas such as safety issues and cracks that may not arise until right before you make the purchase of the home. Perhaps a second follow up inspection may be a good idea if you feel that one of these areas may be a potential problem.

Again, home inspectors are human and they are not above missing some potential problems with your new home. Realize this fact before you have your home inspection so that you too can keep your eyes open for any potential problems you see in and around your prospective new home. Once you move in you will be able to rest assured that you have not bought into a money pit.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Tags: home buying tips, home inspection, orlando avenue top team, Teri Isner

Posted in General Real Estate, Orlando Buyers | No Comments »

December 11th, 2015 by tisner

Still searching for the ideal holiday gift for your adult child? How about helping your child with their first home purchase? Hopefully your child already has a job lined up so that they can afford to pay for their new home once you have helped them to achieve the goal of home ownership, if not you may want to postpone this plan until they do.

- Many kids just out of college have a huge student debt that has accumulated over the last four years but that doesn’t have to stop them from owning their own home. Parents can help their children be able to purchase their own home and to come up with the down payment by gifting the down payment to them. Make sure that you do not loan them the money because that can work against them in the long run, rather give them the down payment as a gift. This type of gift is much better than any house warming gift you could ever give them and it’s the gift that will keep on giving. You will need to write a “gift letter” so that the lender realizes that the money is in fact a gift and not a loan.

- If you simply cannot afford to gift the money for the down payment to your child then you can give them a loan but the lender will have guidelines that you must follow. The lender will consider the loan a second mortgage on the house and you may also be prepared to have interest in the loan as well. The interest rate will most likely be the current market rate.

- You can apply for a mortgage jointly with your child if you want to help out in that way. You will be considered a non-occupant co-borrower. If however your child fails to pay the mortgage, guess who will be responsible for it? Yes, you. This type of help towards a home purchase should only be done as a last resort.

- You may want to choose to let your recent graduate move back home with you until he or she can afford to take on a home mortgage without having to have help from you. By letting them move back in you are allowing them to be able to save money towards a home purchase and that in itself is a huge help in the right direction.

Hopefully this gives you a few ideas on how to help your child afford to purchase a home of their own.

Courtesy of Orlando Realtor Teri Isner.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Tags: 1703 doreen ave, alligator orlando, first home purchase, helping child buy home, home buying tips, orlando real estate for sale

Posted in General Real Estate, Orlando Buyers | No Comments »

November 20th, 2015 by tisner

We have all been there before, getting ready to buy a house and then suddenly something of a negative nature pops up on our credit score that poses to keep us out of our dream home forever. There are ways to make sure you DO NOT end up in this sort of predicament however. Hopefully, the following tips for raising your credit score will be beneficial to you so that you can find your new home!

- Pay credit card bills before the statement date. Many times folks wait until the due date to pay a bill but if you are willing and able to pay them before the statement date, your credit score is likely to improve.

- If you can afford to make multiple payments on your credit balance throughout the month, this will also show favorably on your credit score. Check with your credit card company to make sure you are allowed to do this before beginning because some do not allow it.

- If you only have a couple bad marks on your credit, you can ask for a “good will deletion” . Of course if you are late over and over again you will not be able to reap this reward but if you can show that you otherwise have paid your bills on time you may be able to get those couple nasty marks off your credit and therefore raise your score!

- If one of your accounts has recently gone into collections you may be able to pay it off and have it removed from your credit report as a result. Be sure to get any type of promise to delete in writing so that you can be sure it will be taken off once you pay.

Credit issues can be hard to deal with especially if you are looking to purchase a new home in the near future, but take it from someone who knows….it CAN be done and you CAN have the house of your dreams maybe sooner than you had imagined! Keep working at it and you will succeed and come out the other side ready to move forward into your future!

Courtesy of Orlando FL Realtor Teri Isner!

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Tags: home buying tips, know your credit score, orlando avenue top team, raising credit score, Teri Isner

Posted in Financing, General Real Estate, Orlando Buyers | No Comments »

November 17th, 2015 by tisner

![Slaying Myths About Buying A Home [INFOGRAPHIC] | Keeping Current Matters](https://www.keepingcurrentmatters.com/wp-content/uploads/2015/11/Slaying-Myths-KCm.jpg)

Some Highlights:

- Interest Rates are still below historic numbers.

- 88% of property managers raised their rent in the last 12 months!

- Credit score requirements to be approved for a mortgage continue to fall. The 723 average score is the lowest since Ellie Mae began reporting on scores in August 2011.

- The average first-time home buyer down payment was 6% in 2015 according to NAR.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Tags: home buying myths, home buying tips, myths about buying home, orlando avenue top team, Teri Isner

Posted in General Real Estate, Orlando Buyers | No Comments »

November 4th, 2015 by tisner

Home inspectors are good at their jobs but they are not above missing some things because they are human. There are several things that home inspectors have been known to miss during a home inspection so you might want to keep your eyes open and pay close attention during the inspection so that you don’t end up having to pay for expensive repairs once you move in to your new home. A few things that may be missed by your home inspector are below.

- Inspectors do not always go over all the bells and whistles of a home and appliances are on the list of things they do not always pay a lot of attention to. The last thing you want is to move into your new home to find out that you have a leaky dishwasher that needs to be replaced. If you want to make sure appliances have not been overlooked you may want to check them yourself.

- Leaky faucets are also things that can be overlooked by home Take your time to walk through your soon to be new home and check the faucets for leaks just in case your inspector may have missed something. It’s a good idea to check outdoor faucets as well.

- Cracked sewage and drainage pipes might also be something that your inspector doesn’t take a look at and may therefore miss. It may be worth your while to pay a bit of extra money to have an in depth look at your drainage pipes.

- Sometimes home inspectors will not pay a lot of attention to decks, porches and balconies. There can be problems in these areas such as safety issues and cracks that may not arise until right before you make the purchase of the home. Perhaps a second follow up inspection may be a good idea if you feel that one of these areas may be a potential problem.

Again, home inspectors are human and they are not above missing some potential problems with your new home. Realize this fact before you have your home inspection so that you too can keep your eyes open for any potential problems you see in and around your prospective new home. Once you move in you will be able to rest assured that you have not bought into a money pit.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Tags: home buying tips, home inspection, home inspector, orlando avenue top team, Orlando Sellers, Teri Isner

Posted in General Real Estate, Orlando Buyers | 1 Comment »

November 3rd, 2015 by tisner

Many people wonder whether they should hire a real estate professional to assist them in buying their dream home or if they should first try to go it on their own. In today’s market: you need an experienced professional!

You Need an Expert Guide if you are Traveling a Dangerous Path

The field of real estate is loaded with land mines. You need a true expert to guide you through the dangerous pitfalls that currently exist. Finding a home that is priced appropriately and ready for you to move in to can be tricky. An agent listens to your wants and needs, and can sift out the homes that do not fit within the parameters of your “dream home”. A great agent will also have relationships with mortgage professionals and other experts that you will need in securing your dream home.

You Need a Skilled Negotiator

In today’s market, hiring a talented negotiator could save you thousands, perhaps tens of thousands of dollars. Each step of the way – from the original offer, to the possible renegotiation of that offer after a home inspection, to the possible cancellation of the deal based on a troubled appraisal – you need someone who can keep the deal together until it closes. Realize that when an agent is negotiating their commission with you, they are negotiating their own salary; the salary that keeps a roof over their family’s head; the salary that puts food on their family’s table. If they are quick to take less when negotiating for themselves and their families, what makes you think they will not act the same way when negotiating for you and your family? If they were Clark Kent when negotiating with you, they will not turn into Superman when negotiating with the buyer or seller in your deal.

Bottom Line

Famous sayings become famous because they are true. You get what you pay for. Just like a good accountant or a good attorney, a good agent will save you money…not cost you money.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Tags: adjustable rate comparison, home buying tips, home selling tips, orlando real estate, Orlando Sellers, teri isner orlando avenue top team, why hire real estate professional, why hire realtor

Posted in General Real Estate, Orlando Buyers | No Comments »

September 17th, 2015 by tisner

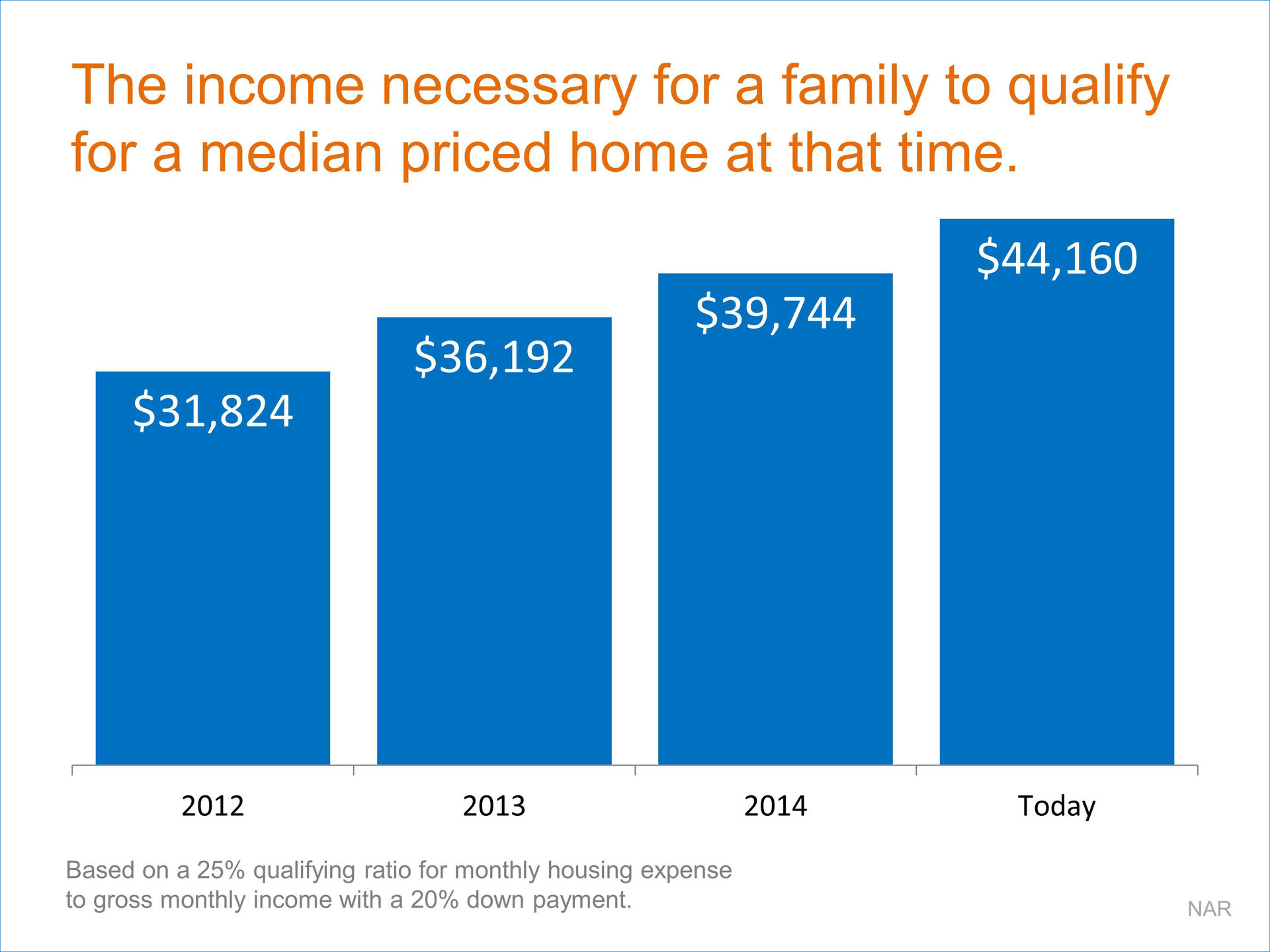

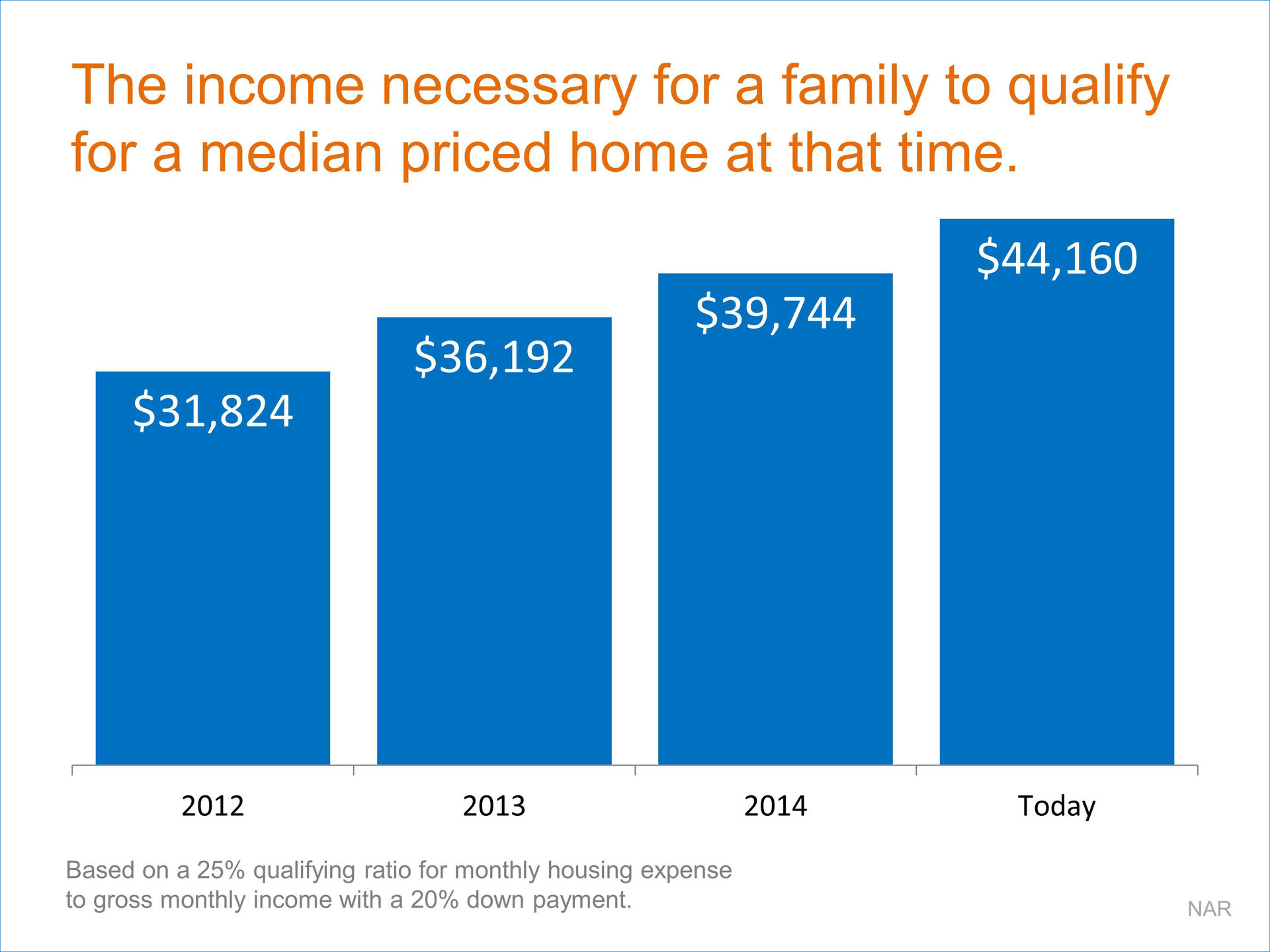

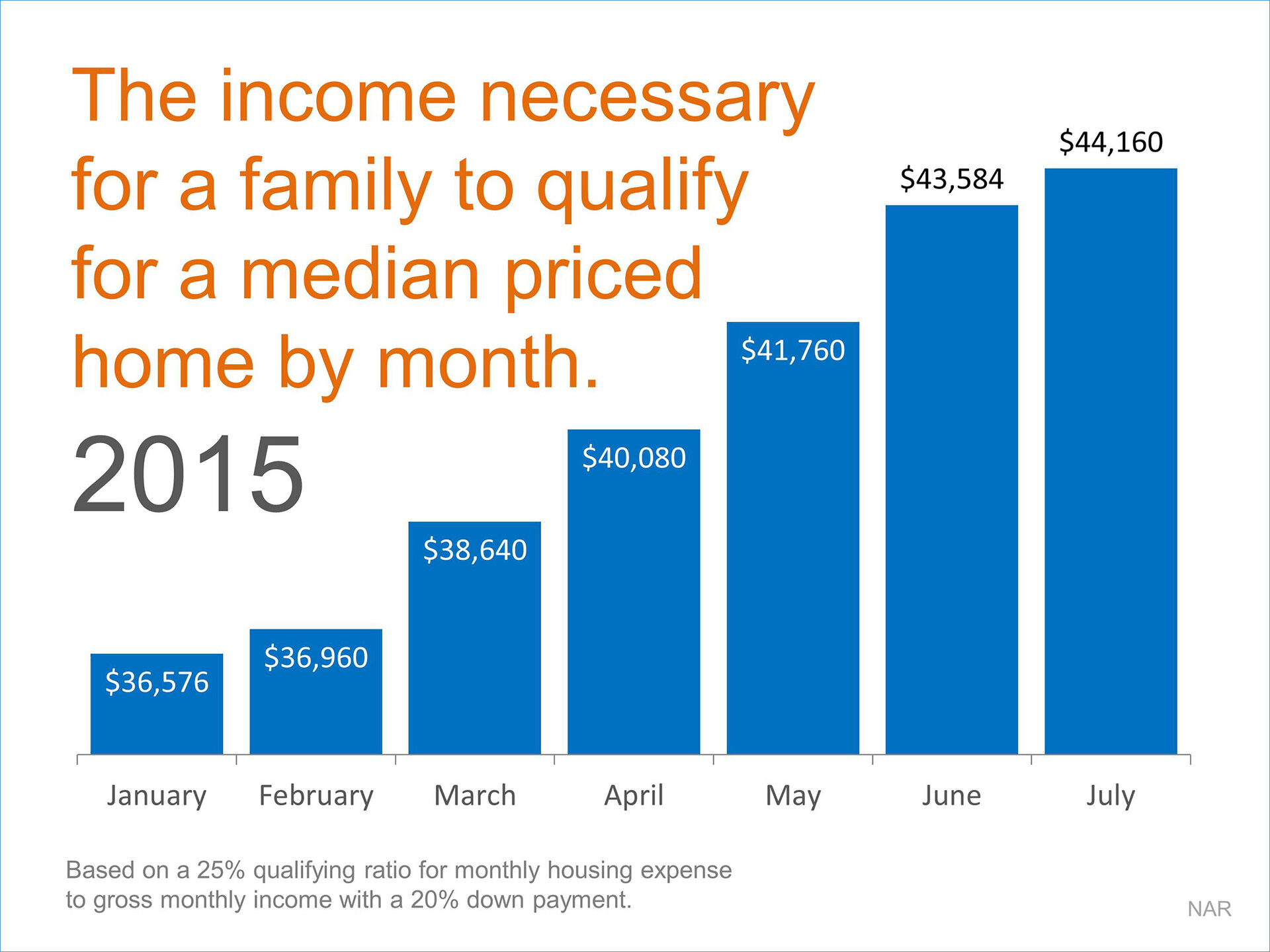

The National Association of Realtors (NAR) recently released their July edition of the Housing Affordability Index. The index measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national level based on the most recent price and income data. NAR looks at the monthly mortgage payment (principal & interest) which is determined by the median sales price and mortgage interest rate at the time. With that information, NAR calculates the income necessary for a family to qualify for that mortgage amount (based on a 25% qualifying ratio for monthly housing expense to gross monthly income and a 20% down payment).

Here is a graph of the income needed to buy a median priced home in the country over the last several years:

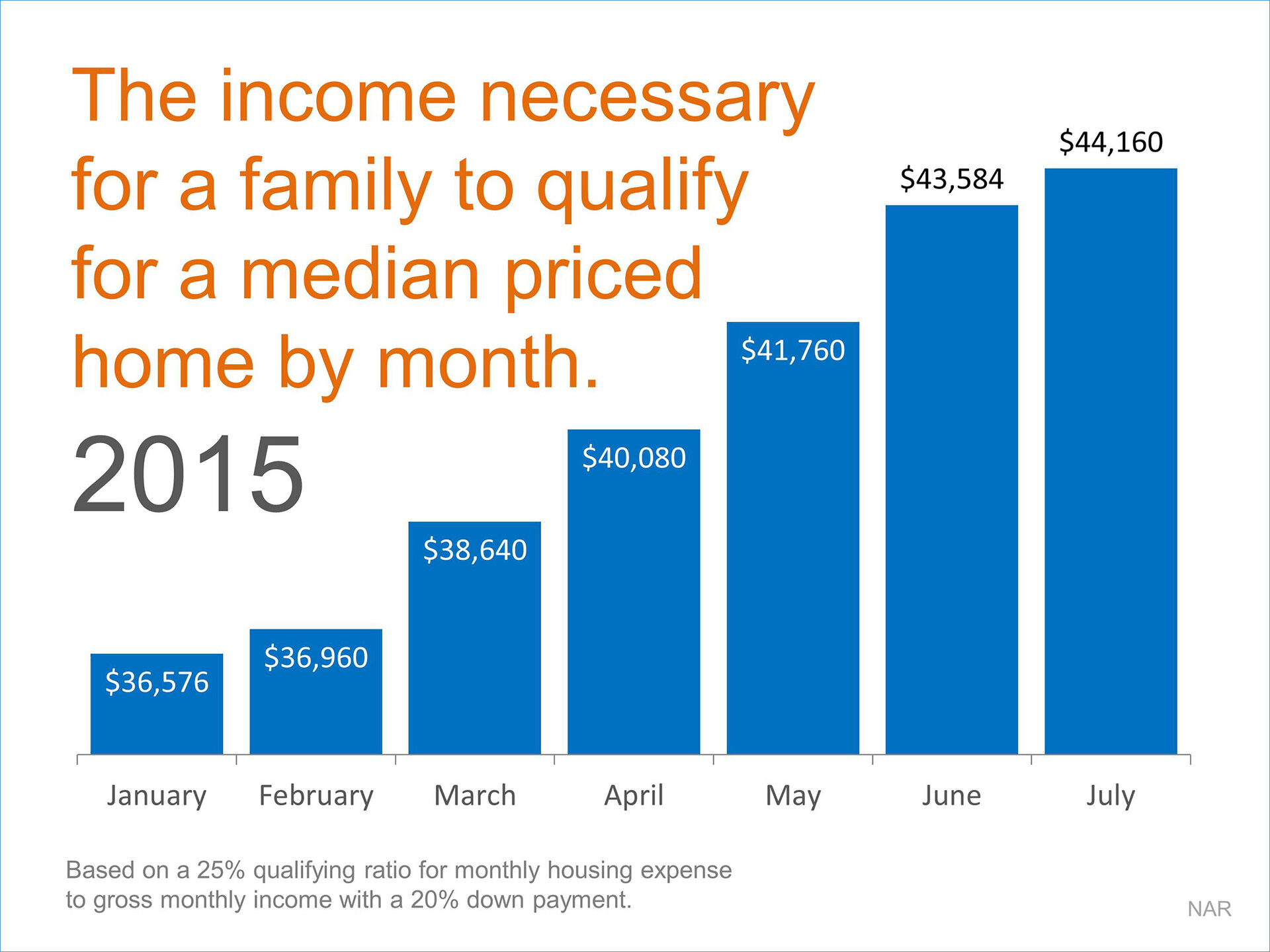

And the income requirement has accelerated even more dramatically this year as prices have risen:

Bottom Line

Some buyers may be waiting to save up a larger down payment. Others may be waiting for a promotion and more money. Just realize that, while you are waiting, the requirements are also changing.

Tags: cost of waiting to buy, home buying tips, Teri Isner, teri isner orlando avenue top team

Posted in About Orlando, Financing, General Real Estate, Orlando Buyers | No Comments »

September 4th, 2015 by tisner

Buying a condo can be a good experience if you know what you are getting into. If you enjoy the easy life but you still want to own your own home, buying a condo may be just the thing for you! Today, we will look into a few things you may want to consider when buying a condo.

- Get to know your HOA if there is one. Find out what you can and cannot do in and around your new condo. Many people take getting to know about their Homeowner’s Association for granted until it is too late and they run into a problem.

- Look into the bylaws of the condo you are thinking about purchasing. You can find out about rules regarding pets, parking, maximum occupant guidelines as well as finding out about things you can and cannot change in the unit if you decide you would rather rent for a while.

- Have the building inspected to see if there will be any need for repairs before you purchase it. This will help you in the long run avoid spending needlessly on things that could have already been fixed before you move in to your new condo.

- Find out what your voting rights might be as a condo owner. You can check this by again looking into the HOA and those that govern it.

- Check into the finances of the condo to see that there are reserves for building maintenance that may come into play in the future.

- Go door to door and get to know your potential neighbors. You will be living in close proximity to your neighbors if you do choose condo life, so spend a little bit if extra time getting to know those around you.

Condo life can be great if you are an empty nester or if you are single or an older individual looking for a more relaxed lifestyle than typical home ownership offers you. The last thing you want to be doing in your later years is worrying about keeping up a house and all that it entails. Start looking into condo life today by doing a bit of research online for condos in your area for sale or rent. There are pros and cons to owning your own condo so be sure to do your research and figure out if living in a condo works for your lifestyle. You may find that you have found the gold at the end of the rainbow by purchasing your own condo.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Tags: buying condo, condo living, home buying tips, orlando avenue top team, orlando real estate, teri isner orlando avenue top team

Posted in General Real Estate, Orlando Buyers | No Comments »

August 12th, 2015 by tisner

Most folks these days are living paycheck to paycheck and are having a hard enough time trying to pay all of their bills on time. This is one of the biggest reasons many people are looking for some sort of down payment assistance when it comes time to purchase a new home. For many people owning their own home cannot become a reality because they simply cannot afford to come up with the down payment needed. Rest assured if you are one of those people who have a hard time coming up with enough money to pay bills much less enough money for a down payment on a house, there is hope for you! Below are a few ideas for down payment assistance and what you need to do to qualify for it.

- Figure out what your adjusted gross income is so that you will know if you can or cannot qualify for down payment assistance.

- Complete a HUD application at your local HUD (The US Department of Urban Development) office. In order to qualify for HUD your adjusted gross income must not be more than 80 percent of the local median income.

- The down payment assistance program from HUD has a limit of 6 percent of the home’s purchase price or $10,000 so be sure that you know what size and price range you are looking for in a home before you apply for assistance. Knowing some of these things beforehand will possibly save you a lot of hassle in the long run.

- You may possibly qualify for a grant that you do not have to pay back such as with the American Dream Down Payment Initiative Program. This program is known as the ADDI. If you need assistance with your home down payment be sure not to let this particular program slip through your fingers.

Hopefully these few ideas for down payment assistance will get you started in the right direction when looking for a home of your own. It is important that you don’t get discouraged and give up when looking for these types of assistance programs. They are out there for the taking you just have to be diligent to look for them and see which ones may be able to assist you in your home buying experience. It is all too easy to give up and not look deep into all the different home down payment assistance programs but I promise you if you do enough research you WILL likely find one out there that is just waiting to help you.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Tags: down payment assistance, home buying tips, orlando avenue, Teri Isner

Posted in General Real Estate, Orlando Buyers | No Comments »

![Slaying Myths About Buying A Home [INFOGRAPHIC] | Keeping Current Matters](https://www.keepingcurrentmatters.com/wp-content/uploads/2015/11/Slaying-Myths-KCm.jpg)