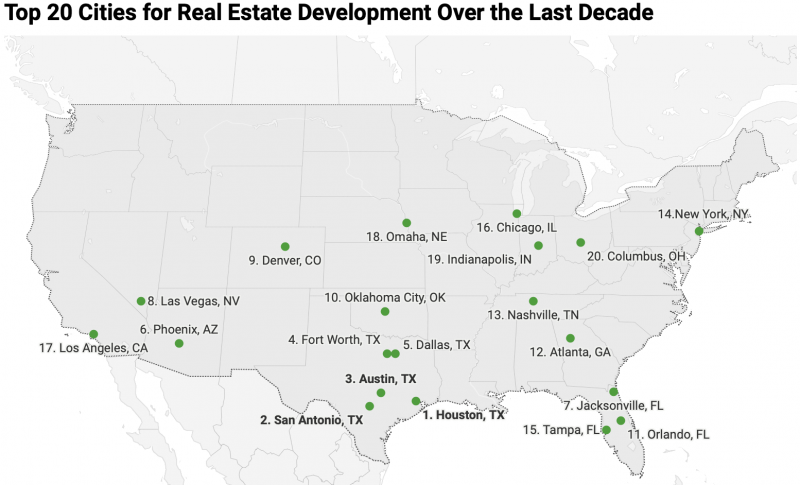

RE Development: 3 Fla. Cities in U.S. Top 20

June 15th, 2023 by tisnerCensus data shows the last decade’s most active development is in the Sun Belt. Texas holds top spots with Jacksonville (7), Orlando (11) and Tampa (15) close behind.

ORLANDO, Fla. – A study of real estate development based on U.S. Census Bureau data covering the last decade finds Texas cities in the top five spots, but three Florida cities are close behind: Jacksonville ranks at No. 7, Orlando at No. 11 and Tampa No. 15.

The analysis from StorageCafe, Yardi Matrix and Commercial Edge found that 15 of the top 20 cities with the highest volumes of real estate construction from 2013 to 2022 were Southern or Southwestern urban hotspots. Texas, however, is “now in a league of its own and boasts the top five best cities for real estate construction.”

StorageCafe analysis of data from the U.S. Census Bureau, Yardi Matrix and Commercial Edge (2013-2022)

For the analysis, researchers say they considered building permits for single-family homes and multifamily units, and new deliveries of square footage in the industrial, office, retail and self-storage sectors – and the self-storage sector saw strong growth.

I’ve asked Doug Ressler, business intelligence manager at Yardi Matrix, a research firm and our sister division, to provide some insights on the state of the development market and self-storage in particular:

“In the face of the recent headwinds felt across the real estate sector, industrial, multifamily and self-storage remained the most preferred commercial assets,” says Doug Ressler, business intelligence manager at Yardi Matrix. “The self-storage sector is currently performing well with new supply at healthy levels and demand stabilizing after the pandemic-induced spike. Street rates are still down year-over-year but the drop is moderating as the prime moving season kicks in. In fact, the average rent for a standard unit is slightly up from the previous month and now sits at $127 per month.”

5 most active Florida cities, 2013-2022

1. Jacksonville

- Single-family permits: 37,000

- Industrial space: 18.7 million square feet

- Self-storage space: 2.6 million square feet

2. Orlando

- Retail space: 8.8 million square feet

- Industrial space: 22 million square feet

- Self-storage space: square feet

3. Tampa

- Retail space: 3.2 million square feet

- Self-storage space: 2.1 million square feet

- Multifamily permits: 21,500

4. Miami

- Self-storage space: 4.7 million square feet

- Retail space: 9.1 million square feet

- Multifamily permits: 45,800

5. St. Petersburg

- Multifamily permits: 9,700

- Self-storage space: 975,000 square feet

- Retail space: 1M square feet

For more information on how the individual commercial sectors, the multifamily sector and residential construction expanded over the past decade nationally and by city – including the three Florida cities in the top 20 – visit StorageCafe’s website.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Source: © 2023 Florida Realtors®

By: Kerry Smith