May 11th, 2018 by tisner

For the last 25 years, most buyers have gotten a new mortgage or paid cash when purchasing a home. For a practical reason, owner-occupant buyers have another alternative: assuming a lower interest rate existing FHA or VA mortgage.

In the late 80’s, both FHA and VA began requiring buyers to qualify to assume their mortgages. Prior to that, good credit or even a job wasn’t required. The real reason there haven’t been significant numbers of assumptions in the past 25 years is that interest rates have been steadily going down. If a person had to qualify, they might as well do it on a new loan and get a lower interest rate.

Even though mortgage money is currently attractive and available, it is at a four-year high. When interest rates on new mortgages are higher than the rates of assumable FHA and VA mortgages originated in the recent past, it may be more advantageous to assume the existing mortgages. Conventional loans have due on sale clauses that prevent them from being assumed at the existing rate.

FHA loans that originated with lower than current interest rates have great advantages for buyers and sellers.

- Interest rate won’t change for qualified buyer

- Lower interest rate means lower payments

- Lower closing costs than originating a new mortgage

- Easier to qualify for an assumption than a new loan

- Lower interest rate loans amortize faster than higher ones

- Equity grows faster because loan is further along the amortization schedule

- Assumable mortgage could make the home more marketable

This financing alternative can save money for the buyer in closing costs and monthly payments. While the equity may be more than the down payment on a new mortgage, second mortgages are available to make up the difference. Call us at (407) 467-5155 to find out if this may be an option for you.

By: PatZaby.com

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

http://go.homeasap.com/homesearch/221183171246872

Tags: buying a house, fha, first time home buyers, home loans, homebuyers, interest rates, mortgages, orlando avenue top team, paying for a house, purchasing a home, Teri Isner, VA mortgage

Posted in Financing, Orlando Buyers | No Comments »

May 10th, 2018 by tisner

The Windermere Real Estate Market Trends Report shows the average sales price was $499,475 in April 2018 compared to $464,453 in April 2017. Homes were on the market for an average of 61 days, down from 90 days last year. Homes sold for 98% of the list price.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

http://go.homeasap.com/homesearch/221183171246872

Tags: home prices, home sellers, home values, homebuyers, homeowners, housing market update, orlando avenue top team, Teri Isner, windermere florida, Windermere Florida Real Estate Market Report for April 2018

Posted in Windermere | No Comments »

May 10th, 2018 by tisner

The Kissimmee Real Estate Market Trends Report for 34741 shows 47 homes sold in April 2018 up from 34 in April 2017. The average sales price was $180,288 compared to $138,271 in April 2017 and homes were on the market an average of 40 days, down from 54 days in April 2017.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

http://go.homeasap.com/homesearch/221183171246872

Tags: home prices, home sales, home sellers, homebuyers, homeowners, housing market update, kissimmee florida, Kissimmee Florida Real Estate Market Report for April 2018, Teri Isner

Posted in Kissimmee | No Comments »

May 10th, 2018 by tisner

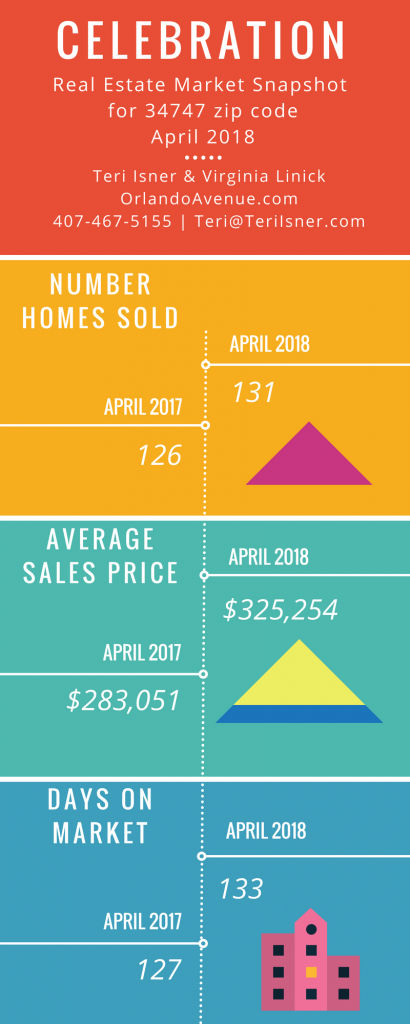

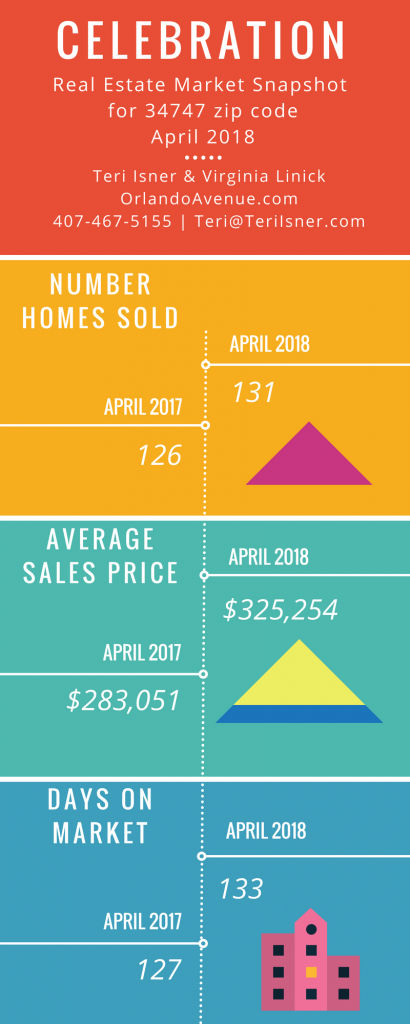

The Celebration Real Estate Market Trends Report for 34747 shows 131 homes sold in April 2018 compared to 126 in April 2017. The average sales price was $325,254 compared to $283,051 in April 2017 and homes were on the market an average of 133 days, compared to 127 days in April 2017.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

http://go.homeasap.com/homesearch/221183171246872

Tags: celebration florida, Celebration Florida Real Estate Market Report for April 2018, home prices, home sales, home sellers, home values, homebuyers, homeowners, housing market update, orlando avenue top team, Teri Isner

Posted in Celebration | No Comments »

April 13th, 2018 by tisner

“How long do we have to wait to qualify for another mortgage” is the question concerning people who’ve had a foreclosure, short sale or bankruptcy. The loan types for the new loan will differ in amounts of time to heal credit scores based on the event.

The following chart is meant to be a general guide for how long a person might have to wait. During this waiting period, it’s important that the person be current on all payments and maintains a history of good credit.

A recommended lender can give you specific information regarding your individual situation and can make suggestions that will improve your ability to qualify for a mortgage. This process should be started before looking at homes because of the time constraints listed here can vary based on current requirements and possible extenuating circumstances of your case.

We want to be your personal source of real estate information and we’re committed to helping from purchase to sale and all the years in between. Call us at (407) 467-5155 for lender recommendations.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

By: PAtZaby.com

Tags: bankruptcy, credit scores, Distressed Sale, foreclosure, home loans, homebuyers, mortgage, orlando avenue top team, short sale, Teri Isner

Posted in Financing, Orlando Buyers | No Comments »

April 12th, 2018 by tisner

The Windermere Real Estate Market Trends Report shows the average sales price was $572,370 in March 2018 compared to $628,003 in March 2017. Homes were on the market for an average of 76 days, down from 103 days last year. Homes sold for 97% of the list price.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Tags: home prices, home sales, home sellers, homebuyers, homeowners, housing market update, orlando avenue top team, Teri Isner, windermere florida, Windermere Florida Real Estate Market Report

Posted in General Real Estate, Windermere | No Comments »

April 12th, 2018 by tisner

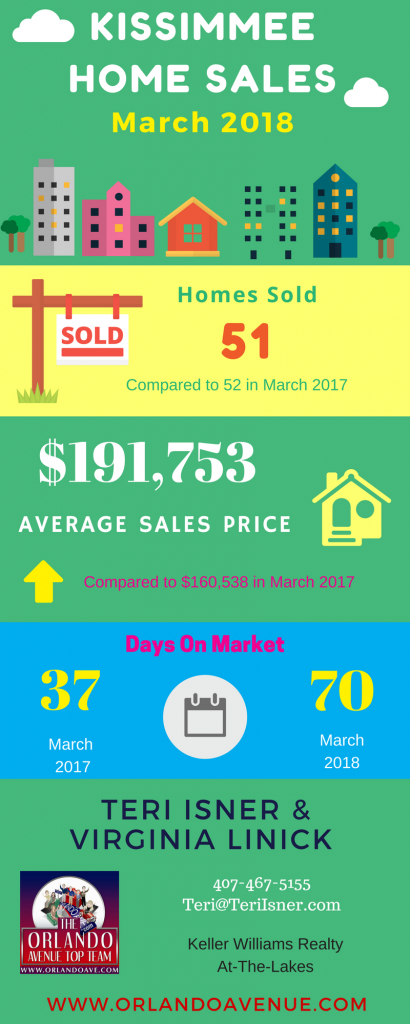

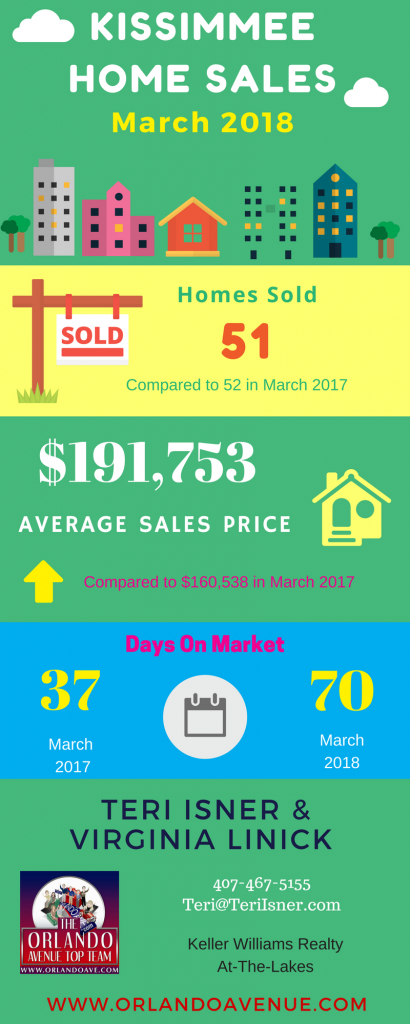

The Kissimmee Real Estate Market Trends Report for 34741 shows 51 homes sold in March 2018 down from 52 in March 2017. The average sales price was $191,753 compared to $160,538 in March 2017 and homes were on the market an average of 70 days, up from 37 days in March 2017.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Tags: home prices, home sales, home sellers, homebuyers, housing market update, kissimmee florida, Kissimmee Florida Real Estate Market Report, orlando avenue top team, Teri Isner

Posted in General Real Estate, Kissimmee | No Comments »

March 29th, 2018 by tisner

The Federal Housing Administration, operating under HUD, offers affordable mortgages for tens of thousands of buyers who may not qualify for other types of programs. They are popular with both first-time and repeat buyers.

The 3.5% down payment is an attractive feature but there are other advantages:

- More tolerant for credit challenges than conventional mortgages.

- Lower down payments than most conventional loans.

- Broader qualifying ratios – total house payment with MIP can be up to 31% of borrower’s monthly gross income and total house payment with all recurring debt can be up to 43%. There is a stretch provision taking it to 33/45 for qualifying energy efficient homes.

- Seller can contribute up to 6% of purchase price; this money must be specified in the contract and can be used to pay all or part of the buyer’s closing costs, pre-paid items and/or buy down of the interest rate.

- Self-employed may qualify with adequate documentation – two year’s tax returns and a current profit and loss statement would be required in addition to the normal qualifying and underwriting requirements.

- Liberal use of gift monies – borrowers can receive a gift from family members, buyer’s employer, close friend, labor union or charity. A gift letter will be required specifying that the gift does not have to be repaid.

- Special 203(k) program for buying a home that needs capital improvements – requires a firm contractor’s bid attached to the contract calling for the work to be done. The home is appraised subject to the work being done. If approved, the home can close, the money for the improvements escrowed and paid when completed.

- Loans are assumable at the existing interest rate with buyer qualification. Assumptions are easier than qualifying for a new mortgage and closing costs are lower.

- An assumable mortgage with a lower than current rates for new mortgages could add value to the property.

Finding the best mortgage for an individual is not always an easy process. Buyers need good information from trusted professionals. Call (407) 467-5155 for a recommendation of a trusted lender who can help you.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

By and photo credit: PatZaby.com

Tags: buying a house, Federal Housing Administration, FHA Advantages, first time home buyers, home loans, homebuyers, mortgages, orlando avenue top team, purchasing a home, Teri Isner

Posted in Financing, Orlando Buyers | No Comments »

March 16th, 2018 by tisner

The Windermere Real Estate Market Trends Report shows the average sales price was $521,477 in February 2018 compared to $544,748 in February 2017. Homes were on the market for an average of 91 days, equal to 91 days last year. Homes sold for 97% of the list price.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Tags: home prices, home sales, home sellers, homebuyers, homeowners, housing market update, orlando avenue top team, Orlando Sellers, Teri Isner, windermere florida, Windermere Florida Real Estate Market Report

Posted in General Real Estate, Orlando Buyers, Windermere | No Comments »

March 16th, 2018 by tisner

The Kissimmee Real Estate Market Trends Report for 34741 shows 37 homes sold in February 2018 down from 54 in February 2017. The average sales price was $185,898 compared to $146,058 in February 2017 and homes were on the market an average of 50 days, down from 65 days in February 2017.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Tags: home prices, home sales, home sellers, homebuyers, homeowners, housing market update, kissimmee florida, Kissimmee Florida Real Estate Market Report, orlando avenue top team, Orlando Sellers, Teri Isner

Posted in General Real Estate, Kissimmee, Orlando Buyers | No Comments »